Customer Experience Is Customer Retention

A positive customer experience should be a goal for every transaction and interaction, especially when it comes to disputes. Every dispute is an opportunity to retain a loyal customer or create a new one. Sellers can capitalize on that opportunity by providing a fair and speedy dispute resolution. Doing so can foster a positive customer interaction with lasting rewards.

In a recent survey on customer experience, 73% of all customers rate customer service as an important factor in purchasing decisions. Additionally, 32% of customers said they will never do business with a company again after just one negative experience. Disputes, while adversarial in nature, can be turned into examples of excellent customer service with the right tools and know-how. Doing so just might save a relationship.

Verifi’s Customer-first Services

With the proper technology, managing a transaction inquiry at the pre-dispute stage is an opportunity for sellers to provide excellent customer service. According to a recent survey, 64% of consumers and 80% of business buyers expect “real-time” responses and interactions; and 80% of consumers said that an immediate response influences their loyalty to a brand. Fortunately, Verifi’s solutions are uniquely positioned to deliver this vital response time to consumers when it comes to pre-disputes.

Since 2005, Verifi® has been at the forefront of nimble, collaborative dispute management. Verifi realized that customers often file disputes because they did not recognize a transaction due to unclear billing descriptors or a lapse in memory. Verifi’s PREVENT solution, featuring Order Insight®, allows sellers to extend their customer service into issuer call centers by providing transaction details at the point of inquiry, immediately alleviating customers’ concerns and giving them peace of mind. As a result, Verifi’s PREVENT solution deflects up to 42% of pre-disputes by clarifying confusion around transaction details.

Rapid Dispute Resolution – Real-time Dispute Management

If a pre-dispute is not deflected by the PREVENT solution, it enters Verifi’s RESOLVE solution, which enables sellers to resolve pre-disputes before they escalate into a formal chargeback. The newest product in the RESOLVE suite is the soon-to-be-launched Rapid Dispute Resolution (RDR). Fulfilling the customer need for immediate response, RDR provides real-time resolution for pre-disputes according to rules defined by sellers.

Using RDR, sellers define the parameters for accepting or declining liability of pre-disputes. When an RDR-participating issuer submits a pre-dispute on the Visa Resolve Online platform for a transaction with an RDR-participating seller, that pre-dispute is auto-decisioned according to the seller’s rules. The outcome – either the acceptance or declining of liability – is communicated in real time to the issuer, along the Visa Network, which can provide an immediate response to the cardholder in turn.

Customers don’t like waiting, especially when it comes to customer service issues. In terms of disputes, RDR ensures that customers never have to wait for an answer.

Collaborative Dispute Management Solutions

Good customer service rarely exists in a vacuum. When it comes to disputes, it often takes multiple parties in the payments ecosystem working together to facilitate a positive customer experience. Issuers interface with cardholders to field the dispute inquiry. Sellers interface with issuers, providing feedback on the pre-dispute. And acquirers ensure that funds are moved in a timely manner when necessary. Verifi’s solutions have always prioritized collaboration among these groups, and Rapid Dispute Resolution will continue this tradition, taking full advantage of automation and real-time decisioning.

Treating Disputes as the Opportunities They Are

Disputes can present a turning point in the customer relationship when sellers and issuers treat disputes as opportunities for excellence in customer service. When that happens, the issuer’s card remains top of wallet, and the seller saves time and money and creates a stronger brand through customer loyalty. Ultimately, the payments ecosystem has one less friction point and one more satisfied customer.

Learn more about Rapid Dispute Resolution.

Rapid Dispute Resolution

The rapid growth of e-commerce in recent years has brought about great demand for technological advancement to accept and process digital payments. As online transaction volume grows, there has been an evident rise in disputes, leading to the need for new technology to prevent and manage fraud and disputes. The first half of 2020 has seen some extraordinary changes in online sales and services, including disturbing reports on the increase of disputes. For starters, in May 2020, global e-commerce sales grew 81% over May sales of the previous year. At the same time, non-fraud chargebacks increased 25% overall. Disputes are on the rise, and current mitigation solutions may not be sufficient. The payments industry needs new technology to manage the volume. Fortunately, Visa and Verifi have developed the latest solution for sellers and issuers alike – Rapid Dispute Resolution (RDR).

RDR was designed to deliver dispute resolution in real time, driven by an automated decision engine. Sellers can customize rules to auto-resolve disputes at the point of first customer inquiry, to stop disputes from escalating to chargebacks. As a result, seller accounts are protected from increased chargeback ratios, more issuer-submitted disputes are resolved to reduce chargeback volume, and the customer experience improves overall. RDR eliminates the manual work typically involved in reviewing and resolving routine disputes, relieving undue demand on seller operations. Rapid Dispute Resolution is the essential tool for this age of high-volume e-commerce.

The E-commerce Explosion

Now, there is no shortage of ways to make purchases. The unprecedented sophistication of online payments has branched into increased channels of purchasing opportunities for businesses and consumers, often referred to as omnichannel purchasing. These advances, such as Internet of Things (IoT) and digital wallets, have benefited many but have also allowed new vulnerabilities for fraud and dispute manipulation. Innovation in fraud and dispute prevention technology must exceed the concept of anticipation and scalability and address these challenges at the root, when customers present inquiries and disputes to their issuers. RDR is one such technology.

Fraud Reporting and Chargeback Protection

To understand the necessity of implementing real-time dispute resolution, it is important to briefly review dispute management in the age of e-commerce. In an effort to improve fraud prevention, sellers have solely depended on accessing TC40 data claims files and reconcile that data with their customer history and transaction data. Use of this information can be effective in preventing future fraud or even informing sellers that a dispute had been filed, but it provides no proactive guarantee to prevent disputes and chargebacks in real-time. Although this continues as a sensible practice to reduce future fraud and disputes, it has little effect in current frictionless payment channels that are too often vulnerable to real-time fraud and dispute challenges.

The data in these files is submitted by issuers after a fraud claim, then distributed to the payment card networks and compiled in the Risk Identification Service (RIS) report for Visa and the System to Avoid Fraud Effectively (SAFE) report for Mastercard. Once compiled, they are made available to acquirers and sellers. These reports comprise a tremendous amount of data, which can require a lengthy manual review by sellers before acting on the information. In short, quick solutions for fraud and dispute management are not an option with this method.

Real-time disputes and chargebacks still threaten sellers with the compounded loss of revenue, diminished customer loyalty, and damaged brand equity. Sellers need a more agile way to react to disputes in real time.

Direct Fraud & Dispute Notifications

The next development in fraud and dispute management came in the form of early notification solutions for sellers. Sellers needed technology to deliver more accurate fraud and dispute data faster to prevent disputes from being submitted for processing into chargebacks. Resolving disputes prior to entering an issuer’s dispute process could prevent fraud filings and provide customers a better experience overall.

Enter Verifi’s Cardholder Dispute Resolution Network™ (CDRN®) – the first direct-to-issuer integrated solution providing sellers the opportunity of dispute resolution prior to an issuer’s inescapable chargeback process. Now, sellers could act quickly on near real-time dispute notifications to prevent the compounded losses from the risk of unresolved disputes and chargebacks.

Automated Dispute Resolution – RDR

We have now entered a new era in payments and dispute management. Collaboration and data-sharing among sellers, acquirers, and issuers have become a necessity in the effort to preserve customer relationships and reduce the wide-ranging damage caused by fraud and disputes. RDR’s automated dispute decisioning is the first of its kind in the payments industry. Enabling real-time dispute resolution significantly benefits all players in the payment ecosystem.

- Sellers: Hands-off dispute resolution, no manual review, no impact on dispute ratio, automation accommodates new and evolving business models

- Preserve brand reputation

- Deliver better customer experience through quicker resolution at point of inquiry

- Acquirers: Provide differentiation in seller services

- Retain and grow existing client base

- Increase value with platform services

- Issuers: Reduce dispute processing volume and provide an overall better cardholder experience

- Reduce demand on operations and costs for disputes

- Easily meet governmental and industry regulation requirements

- Reduce write-offs and other liabilities

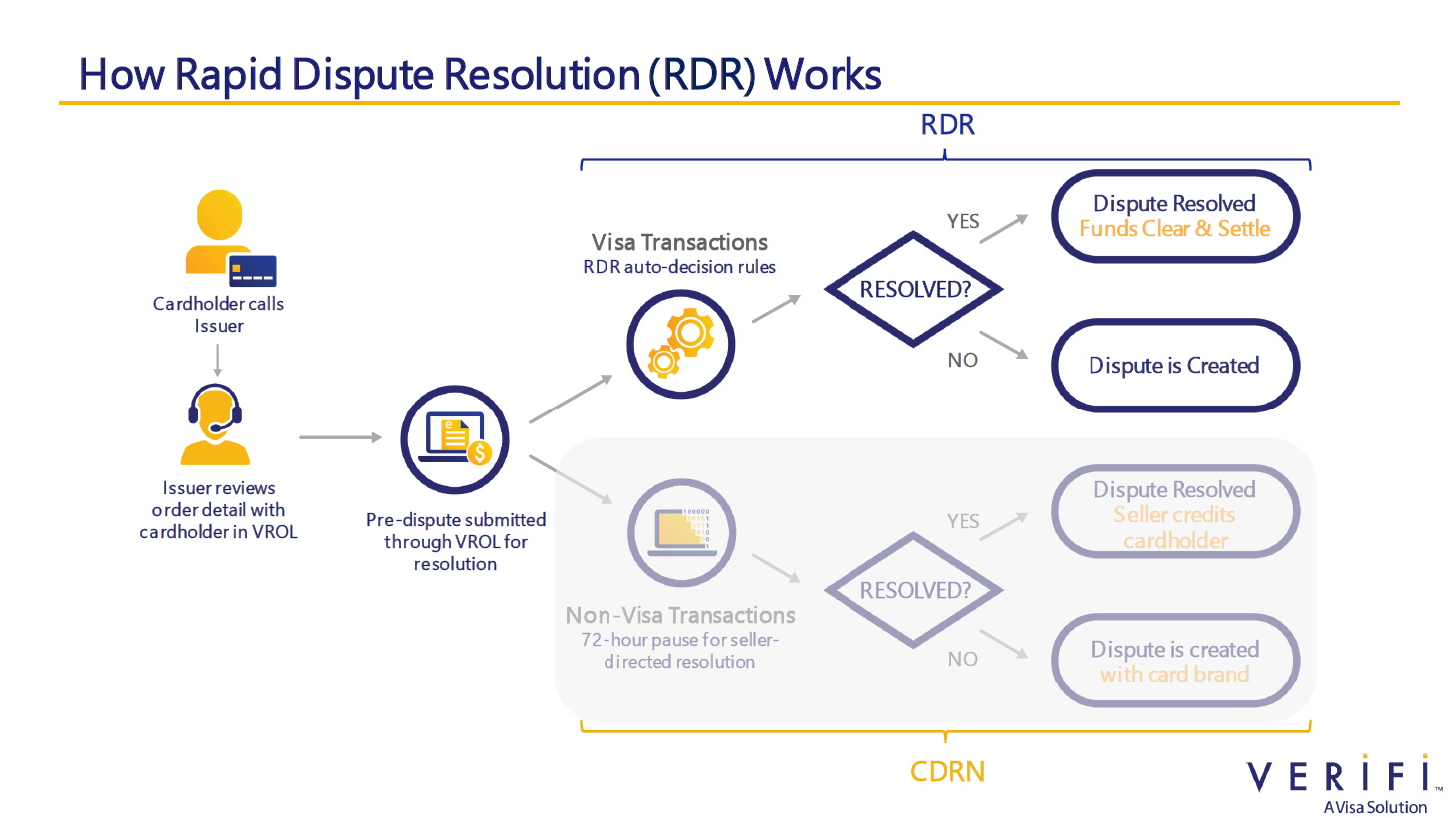

How RDR Works

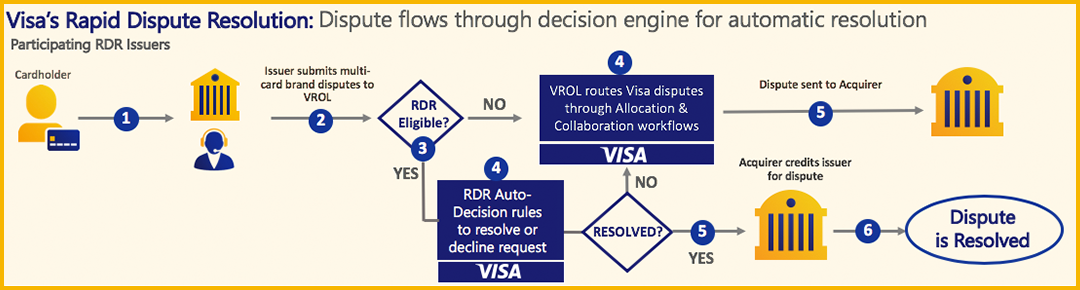

RDR is enabled in Visa issuers’ dispute management platform, Visa Resolve Online (VROL). Once a transaction dispute is submitted into VROL, it is automatically reviewed by the RDR decision engine embedded in the Verifi platform, and a decision is made to resolve based on pre-set, seller-defined rules and attributes. Qualifying disputes are automatically resolved and funds are moved from the seller’s acquirer to the issuer.

Example scenario of RDR in action: A seller has determined that fraud disputes under a certain value, e.g. $20, should be typically refunded. The seller will simply define one rule for both fraud disputes in Visa dispute category 10.X – fraud and disputes equal to or less than $20. When a dispute is submitted that is categorized as fraud and is valued at $20 or less, RDR will immediately trigger a resolution, and Visa will notify the acquirer on existing rails to automatically move funds to the issuer for that transaction.

In real time, all parties along the payment chain are made aware of the resolution, and the process of moving funds from acquirer to issuer is initiated. From this point on, the process requires no manual review or any kind of action on the seller’s part.

The RDR Difference

As the first of its kind, RDR will provide the payments industry with the ability to automatically resolve select transaction disputes in real time – seamlessly and without any additional operational demands. The built-in scalability will ensure that RDR best serves specific business needs, resolving fraud and non-fraud disputes, protecting brand equity, and improving customer services for sellers, acquirers, and issuers on a global scale in the e-commerce age.

To learn more about how RDR can protect your business, contact us today.

Reference

Rapid Dispute Resolution

Rapid Dispute Resolution

Earlier this year, Verifi introduced a new product, Rapid Dispute Resolution (RDR), in collaboration with Visa. RDR is powered by a robust decision engine that automates dispute resolutions based on rules set by the seller, reducing time and effort invested in managing and resolving dispute volume. As a feature of Verifi’s new RESOLVE solution, RDR alongside Verifi’s Cardholder Dispute Resolution Network™ (CDRN®) provide the most effective dispute mitigation solution to serve on a global scale. After months of collaboration with Visa and our client partners, we’re proud to announce that Rapid Dispute Resolution is launching soon.

“RDR came about as a network option to provide an expedited resolution for a dispute without having to handle the refund transaction ‘off-network’ but taking advantage of the benefits of the existing CDRN solution,” says Hitesh Anand, Chief Product Officer at Verifi. “RDR provides a seamless integration for issuers without having to change what they do today to process a dispute. Issuers benefit because they are able to resolve cardholder pre-disputes in real-time. Sellers benefit because disputes that the seller would have resolved later anyway as part of the dispute process are now resolved at the pre-dispute stage without any seller overhead of manually refunding the money. Additional benefit for sellers is that RDR auto-resolved disputes will not count against their dispute ratio.” Verifi reviewed internal data and worked closely with our client partners to discover that various sellers would routinely credit disputes that fit certain parameters specific to each business. In exploration and development, we asked how much time, resources, and operational cost could be saved by automating these routine credits? Verifi’s answer is Rapid Dispute Resolution.

Expanded Global Coverage with Visa

Created in collaboration with Visa, RDR has the ability to reach tremendous issuer coverage, quickly. RDR is incorporated within Visa issuers’ dispute management platform, Visa Resolve Online (VROL), making issuer participation as simple as opting in for the service. The Visa network connects to over 61 million seller locations globally and is the largest card brand network with thousands of issuers throughout the world, positioning Visa and Verifi above competitors to take this technological leap forward.

How Rapid Dispute Resolution Works

The issuer submission of a qualifying dispute triggers RDR rules in our decisioning engine. Resolved RDR disputes activate specific messaging in the VROL system. The resulting real-time message includes data elements that immediately notify issuers and acquirers that the resolved dispute is not a chargeback. This notification also immediately notifies acquirers to move funds to the issuer. This seamless communication provides a hands-off dispute resolution service for all participating sellers.

NOTE: Acceptance of liability is not counted towards a seller’s monthly count or chargeback-to-sales ratio.

Automated Decisioning

Automated decisioning is a revolutionary innovation in dispute management. Rules defined by the seller direct the decisioning engine to initiate notification to Visa, the issuer, and the acquirer that funds should be moved from the acquirer to the issuer on the disputed transaction. For example, a seller can set a rule to accept liability on any dispute on transaction amounts of $25 or less. Sellers can also set a rule to accept liability on transactions with unique purchase identifiers that are passed through with the transaction. So, a seller can better serve a longstanding customer and ensure their continued loyalty.

Initially, rules will be defined by sellers through a simple rule selection guide provided by a Verifi customer support representative. Once the rules are confirmed, submitted per BIN and CAID and set in Verifi’s system, the seller will go live on the global system.

A More Complete RESOLVE Solution

RDR joins CDRN as a new feature of Verifi’s RESOLVE solution. Both dispute management services help resolve disputes before they escalate to a chargeback and impact a seller’s dispute ratio; however, there are some important differences in their functionality and how they can best serve a seller’s particular needs. CDRN allows participating issuers of all major card brands to direct confirmed dispute notifications to the seller for hands-on review, resolution, and seller-initiated credit. Disputes filed with participating Visa issuers are routed through RDR into our innovative decisioning engine for automated resolution, which is determined by a seller’s defined rules. Furthermore, RDR extends coverage on a global scale like never before, taking the strain off seller business operations and providing an improved customer journey in real time.

The RDR Difference

Since 2005, Verifi has been a leader in the payment industry as an innovative and disruptive force in dispute management services. Verifi’s CDRN bridged the gap between issuers and sellers, allowing disputes to be resolved before they escalated. Now, RDR streamlines that resolution process by automatically resolving disputes at the point of submission, which would have been manually credited before. With the launch of RDR, Verifi and Visa will lead a new path for issuers, acquirers, and sellers to work in collaboration to reduce disputes throughout the payment ecosystem, as well as provide a better customer experience. “The industry is going to look at RDR positively,” Anand says. “RDR is leading the way for Visa and Verifi to use more automated decision making, rules, and machine learning to reduce the number of disputes and increase consumer satisfaction with both issuers and sellers.”

Payment solution providers, eager to differentiate their offer of a secure and effective platform to e-commerce businesses, will benefit by boosting their value-add services with RDR. Additionally, issuing banks can provide a more seamless and frictionless service to their customers to ensure greater satisfaction and loyalty.

RDR was devised to address the needs and goals of all principal players in the payment industry. Automated technology is becoming the standard in customer service, and Verifi and Visa will continue our joint commitment to lead innovation that identifies and serves those needs.

For more information on Rapid Dispute Resolution or to sign up for service, contact Verifi today.

COVID-19 Risk Management Impacts and Tips for Sellers

Shelter-in-place orders and mandatory lockdowns have shifted consumer behavior significantly. Not only are consumers largely restricted from leaving their homes, preventing them from visiting stand-alone businesses and shopping centers, but state and regional mandates are forcing non-essential retailers to remain closed during lockdowns. As a result, consumers have turned to e-commerce, m-commerce, and third-party marketplaces for their shopping needs. In fact, a 2020 Remote Payments Study reports a 34.9% increase in online retail purchases year-over-year. As authorizations rise, a similar rise in disputes is likely to follow. Sellers must be prepared for the volume increase in both areas.

Increased online shopping activity has resulted in strained operations for many sellers. Departments like customer service and shipping have been impacted heavily by this spike in demand. Compounding this issue are shelter-in-place orders that prevent workers from performing their duties due to their non-essential status. As a result, two-day shipping may turn into two-week shipping, or logistics may begin to lose track of packages amidst the influx of orders.

Theft will also be a factor. According to a 2018 study, 15% of all deliveries in urban areas do not reach customers on the first attempt. In fact, in New York City alone, over 90,000 packages are stolen or go missing every day. With more people concentrated in urban and residential areas during a time of reduced access to ordinary resources, numbers could soar. As unemployment rises due to COVID-19, sellers can expect an increase in unconfirmed deliveries and complaints.

Customers whose expectations for delivery aren’t met and who can’t track their purchases are likely to file a dispute rather than contact the retailer. In fact, up to 76% of all customers bypass the seller with a dispute, according to “The Chargeback Triangle” from Javelin Strategy & Research, commissioned by Verifi. Unfortunately, seller personnel responsible for payments and dispute management may not be available due to furlough or layoff. One company that provides events organization services has a single person dedicated to fighting chargebacks. In such a situation, sellers should consider outsourcing dispute management to lower their risk profile.

Mitigating the Risk – Best Practices

Communication is key for the success of any relationship, and that remains true between sellers and their customers. Whether the seller provides finished goods or services, customers want to be informed about how their experience might be impeded by COVID-19 impacts. As such, many businesses have provided pre-transaction communications to help assure their customers’ satisfaction. For example, Amazon posts a message at checkout that delivery times may take longer than usual, which can help to align customer expectations due to possible strain in delivery channels. In the same vein, extra post-transaction communication can also help improve the customer journey and prevent disputes.

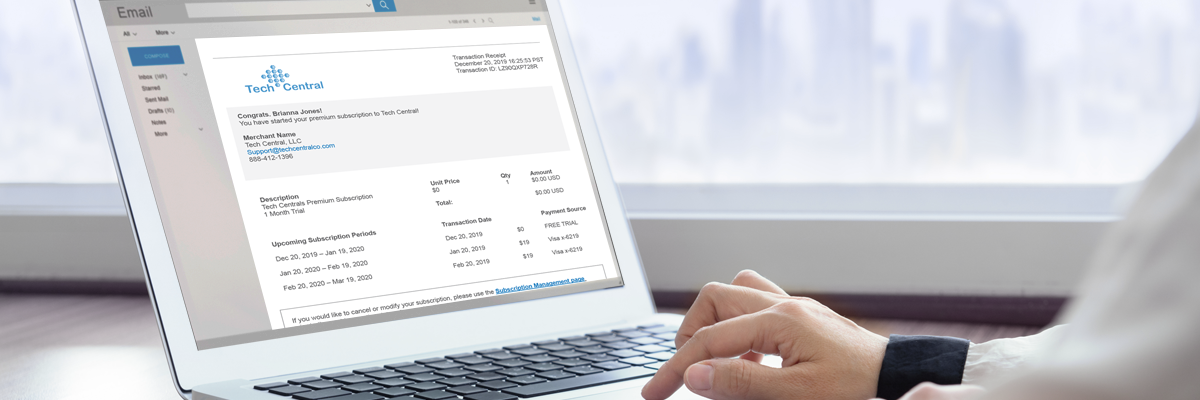

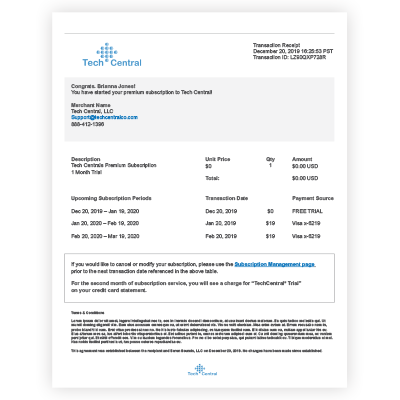

The purchase confirmation email is a powerful tool for providing clear communication to the customer. In the email, sellers can include return and refund policies as well as links to terms and conditions. If the provided service is subscription-based, then the email can include specific details regarding subscription terms and clear instructions on how to opt out. Finally, if physical goods are being delivered, then including shipping and tracking information is a sensible way to keep the customer informed and confident about the pending receipt of their purchase.

In a recent interview, successful entrepreneur Mark Cuban said, “…I want to do everything via email because that allows me to go back and look something up.” Since a purchase confirmation email is transactional, the customer cannot opt out and must receive the communication. As a result, assuming the email has all of the pertinent information, it can be a persuasive and compelling document in a dispute representment case.

Communicate Service Level Agreements

The novel coronavirus is creating unexpected demands and challenges for e-commerce businesses. Sellers may need to adjust their service level agreements and reset expectations of return and refund policies. In such cases, sellers should communicate those changes as early and as visibly as possible via email, website updates, and in-store signage.

Sellers need to be flexible in this uncertain time. To that end, dispensing customer credit vouchers is a savvy way to help mitigate increasing dispute volume. Customers who know that they will use a seller’s services in the future when they become available again may welcome having the credit – especially if the seller is willing to attach a loyalty discount. Extending return and refund periods or loosening the terms are other good methods to reduce friction for the customer. Whatever changes the seller makes, it’s always important to be proactive in communication of those changes.

Despite a seller’s best efforts, some disputes will escalate into chargebacks. Successful representment relies on adequate documentation in order to build compelling evidence. Four actions sellers can take to protect themselves include:

- Maintaining CRM/Transaction Data: Sellers should keep detailed records on customer purchasing history and communications during the transaction process.

- Record Subscription Policy Agreements: Sellers must record the time and date a customer agreed to a subscription policy in case the customer denies having been presented it.

- Preserve Customer Communication and Service Logs: An archive of the customer’s interactions with the seller can be a persuasive tool in proving what the customer was aware of and consented to in agreement.

- Capture Data from Alternate Sources: In this age when communication platforms are universally accessible, customers sometimes will communicate over social media their intention to commit fraud against a seller, or inadvertently reveal proof of their use of a product or service later contested. Other times, the customer will work with a seller’s customer service via social media. In either case, it’s important to consider social media platforms as a source for compelling evidence for representment.

Collaboration and Communication for Risk Mitigation

While fraud prevention and other risk management tools used at authorization can help ensure sellers protect their revenue, as well as customer loyalty, data-sharing collaborative solutions serve as the best measure to prevent disputes from entering the payment ecosystem. Such innovative SaaS solutions help protect sellers, acquirers, and issuers alike from the operations-obstructing and damaging costs of disputes.

Since 2005, Verifi has been leading the payment industry in disputes management services. Now, more than ever, these solutions can help protect sellers’ brands in current and possible future disputes surges.

PREVENT: Enables sellers to share contact information and transaction data on our secure global data network directly with issuers to deflect unwarranted disputes and identify friendly fraud.

RESOLVE: Empowers sellers to resolve disputes before they are filed by the issuer and escalate to costly chargebacks. Rapid Dispute Resolution (RDR) will provide automatic dispute resolution via a decision engine with customized rules set by the individual seller.

RECOVER: Our team of specialists perform representment services to businesses of all sizes, in a wide variety of industries. Our experts do all the work on behalf of our seller partners, determining the best approach to suit specific business needs to maximize revenue recovery.

Verifi’s suite of dispute mitigation solutions can significantly reduce the impact of dispute spikes due to increases in online purchasing, as a result of shelter-in-place restrictions. Verifi’s PREVENT extends seller customer service by enabling issuers to share detailed transaction information at customer inquiry, as well as delivering order data direct to customers via online and mobile banking apps for customer self-resolution. Verifi’s RESOLVE solution provides direct communication between issuers and sellers on confirmed disputes, allowing sellers to resolve a dispute before it escalates into a chargeback. As COVID-19 may continue to increase dispute volume, Verifi’s robust and evolving solutions are well-equipped to manage it – preventing operational drain on strained resources and improving customer experience.

Check back here for Verifi’s next installment of our ongoing series.

Reference

2020 Remote Payments Study – Pyments.com

The Final 50 Feet Urban Goods Delivery System: Common Carrier Locker Pilot Test at the Seattle Municipal Tower – University of Washington

90,000 Packages Disappear Daily in N.Y.C. Is Help on the Way? – The New York Times

The Chargeback Triangle – Verifi

Chargebacks and Coronavirus – RunSignUp

COVID-19: Business Disruption and Changes

The novel coronavirus pandemic has disrupted people’s lives in dramatic ways around the world. From destabilized supply chains to social distancing orders, people are shifting their behavior to accommodate this new reality. Following shelter-in-place requirements, many businesses have embraced remote collaboration technology, like Zoom and Microsoft Teams, eliminating the need for travel. And with concert venues, sports arenas, amusement parks, retail centers, and more shut down, people are replacing those sources of entertainment and shopping with digital subscription services and ecommerce.

COVID-19 has not just altered human behavior but also major industries. As Q1 earnings for 2020 are being released, at least one major airline has reported a loss of 1.7 billion dollars in the first quarter. Similarly, major credit cards are reporting a significant drop in travel spending with one major brand showing figures plummeting 99% in April. Meanwhile, consumers are spending record amounts on digital services, like mobile apps.

As spending behavior changes, it’s important for sellers, issuers, and acquirers to be prepared for new dispute vectors.

Impact on the Payment Ecosystem

Early observation of some business verticals, like online entertainment and gaming, indicates a significant increase in transactions. Year-over-year spend on gaming hardware grew by 63% while gaming software also experienced a healthy 34% increase YoY. Generally, however, an increase in purchasing is followed by an increase in disputes. Given disputes can be filed up to 120 days after the transaction, the results of this increase may not be seen until 4 months from now.

Conversely, other verticals are experiencing a significant increase in disputes currently, such as the travel and hospitality industries. Many consumers who have planned and paid for excursions in advance are either demanding refunds or disputing them outright. But these are not the only affected industries. Pre-paid or subscription-based businesses like gyms and summer camps are considered “non-essential,” which prevents them from delivering the goods or services for which customers have already paid.

Another challenge that sellers, issuers, and acquirers are facing is a lack of resources to combat the spike in disputes. The necessary personnel to help manage transaction inquiries, credits, and/or representments may not be available due to working from home, furlough, or layoff. In those situations, it’s important to have a partnership with a payment service provider with the capacity to manage the dispute volume.

Seller Best Practices

The best way to manage disputes is to prevent an inquiry from escalating. Here are three tactics sellers can employ:

Clear Customer Communications: Ensure clarity in transaction receipts, terms and conditions, and customer correspondence. This will limit the disputes caused by customer confusion.

Proactive Customer Service: Inform customers promptly of any issues that may impact your ability to deliver goods or services for which they have already paid. Informed customers may decide to wait additional time for a needed product or service as long as the timeframe is clear. Uninformed customers may simply dispute their purchases. In addition, consider extending response time for returns (e.g. from 10 days to 30 days), as well as proactively communicating changes on return/refund and T&C policies. In the end, the more informed your customers are, the more likely they will be to reward you with their loyalty.

Picking the Right Battle: It takes time to respond to disputes. That time could be better spent achieving business objectives. Depending on the volume of disputes, sellers must decide which disputes are worth challenging and which ones are easier to just credit.

Verifi Solutions Help Mitigate Increasing Dispute Volume

- PREVENT: This global network enables sellers to share customer support contact information and transaction data directly with issuers to help deflect disputes. This information can help customers remember their transaction.

- RESOLVE: This service enables sellers to resolve disputes before they are filed by the issuer. Issuers on the network will direct confirmed customer disputes to sellers, providing the seller up to 72 hours to act on how best to resolve the dispute. RESOLVE will include Visa’s new Rapid Dispute Resolution (RDR), which resolves disputes automatically via a robust decision engine with rules set by the seller.

- RECOVER: For 15 years, Verifi has been the leader in dispute representment. Our team of specialists provide world-class service, performing all the work on behalf of our seller partners, determining the best approach to suit your business needs and maximize revenue recovery.

Verifi’s and Visa’s Response to Minimize Impacts

Verifi and Visa teams have built initiatives and programs to help all involved in the dispute ecosystem manage disputes, minimize revenue losses, and maintain optimal customer experience.

Visa COVID-19 Dispute Monitoring Program

On April 1, 2020, Visa created the COVID-19 Dispute Monitoring Program. This program was launched with the purpose of reducing invalid disputes from entering the ecosystem. This includes failing to provide a detailed description of the services/merchandise purchased or processing a dispute without attempting to resolve directly with the merchant (unless prohibited by local law). This initiative states that Visa will monitor issuer volumes of disputes raised with sellers. The initiative also outlines that Visa will step in if too many illegitimate disputes are being filed.

Verifi Seller Directory

At the beginning of April 2020, the Verifi Seller Directory was created and made available to Visa issuers to help mitigate customer disputes. Access to seller contact details, refund & return policies, company statement on COVID-19, frequently asked questions (FAQs) and more inform issuers to help mitigate disputes with the customer, or provide seller contact information for the customer to enable direct resolution.

Going Forward

The disruption caused by COVID-19 is far from over; however, some companies in the travel industry are reporting that their dispute volume is leveling off while at least one company in a different industry has reported a 40% decrease in recent dispute volume. It’s too early to tell what this data signifies. Has the payments ecosystem reached the downward curve of disputes? Is this dip in disputes simply a leading indicator of a spike in pre-arbitration or arbitration cases? Time will tell.

The longer shelter-in-place orders are enforced and non-essential businesses are prevented from operating, an increase in dispute volume should be expected. Most likely, this will be due to rising unemployment and decreased cardholder spending power. VOD and mobile apps and services could be the next hotspot for disputes in the near future.

On a long enough timeline, the artificial consumer behavior driven by COVID-19 mitigation practices will become habit. As companies trust their employees more to work remotely and people sheltered-in-place come to rely on food delivery services, the world may never return completely to its pre-COVID-19 state. As pandemic mitigation efforts continue, the payments ecosystem should accept this reality as the new normal.

The Verifi Commitment

While COVID-19 is a health crisis, it’s also causing a payments industry crisis by way of increased disputes volume. Verifi supports sellers impacted by this crisis by connecting them with issuers to share transactional data that can help prevent a dispute before it’s escalated. Verifi also empowers sellers to resolve disputes by issuing credits instead of accepting a chargeback. Finally, Verifi helps recover lost revenue by fighting chargebacks with expert representment services. Verifi is committed to helping its clients and partners survive and thrive during these extraordinary times by providing new insights, information, and expert industry predictions.

Check back soon for part two of this ongoing blog series.

Digital shopping has become the new normal due to store closures, reduced in-store product availability, and restrictions placed on physical shopping. As a result, online shopping has increased by 35% from 2019 figures. Visa has identified six truths affecting sellers which help direct how Visa will prioritize products and services in the near term. Those six truths are:

- Buyers are shifting to digital-first commerce regardless of product

- Small businesses seek paths to quick recovery

- Secure and immediate digital access to funds is a top priority

- Contactless payment options are necessary for health and safety

- Business decisions require the right data and insights

- Transparency and protections are key to the buyer/seller relationship

Verifi provides the pre- and post-dispute solutions buyers and sellers need for business transparency and protection. Verifi can PREVENT and RESOLVE disputes before they escalate into chargebacks. Read Visa’s recent blog post for more insight and an explanation on this important partnership.

Henry Ford specifically set out to revolutionize how automobiles were manufactured. Since then, his “assembly line” process has been widely adopted to build everything from computers to hamburgers. Even if your business may not depend on coding or provide Software as a Service (SaaS), there are eye-opening lessons in process, methodology, and team management to learn from a coding team in fintech.

Henry Ford specifically set out to revolutionize how automobiles were manufactured. Since then, his “assembly line” process has been widely adopted to build everything from computers to hamburgers. Even if your business may not depend on coding or provide Software as a Service (SaaS), there are eye-opening lessons in process, methodology, and team management to learn from a coding team in fintech.

Critical review at the right time

Verifi Software Engineer Taylor Caswell has a keen understanding of the importance of timely review when producing a complex software product. “Providing feedback early in the development process helps us avoid wasted work and wasted time,” Caswell says. Whether building a pizza or a video game, there are critical reviews to ensure you have the foundation to move forward and your build is on the right track. It’s not just getting the team together that matters, it’s the awareness of the individual mindset of each team member, their understanding of what their part is in product development, and the critical thinking they bring to the whole enterprise that determine successful process.

“Every developer has their own strengths and weaknesses. If you are a domain expert, pay careful attention to the domain. If you have a knack for clean code practice, keep your eyes out for that in particular. We work in teams for a reason. Do what you do best,” Caswell suggests. That’s not to say a fix, workaround, or epiphany can’t come from someone with peripheral knowledge of a subject. In these situations the person with the idea or comment should table it as a suggestion and not an answer.

What if there are differences of opinion?

When you have a room full of people, you also have a room full of opinions. Mix this with individual accountability and pride of work, and there is every opportunity for the raising of hackles and the ruffling of feathers. Caswell speaks from experience when he says, “People (including myself) are more likely to be more comfortable having their initial code or proposal overruled if it comes from an inclusive team rather than a single opposing developer or manager.”

Differences of opinion are normal, healthy, and expected. Staying loose and open-minded is key according to Caswell. “As a team, we discuss the problem and weigh the solutions. Sometimes we’ll pick one of the two options in contention. Other times, we’ll come up with an entirely new solution that exceeds the initial disagreement entirely.”

How to foster a positive review culture

Extroverts and alpha personalities aside, it takes time and concentrated effort to build an atmosphere of trust. When it comes to individual work and pride of ownership, coupled with a complicated product and an approaching go-to-market date, it can create a tense environment. Caswell has some suggestions to keep things productive while keeping the peace. “Avoid comments that feel like personal attacks with a simple trick: leave them in the form of inclusive questions. Instead of writing, ‘This method is too long,’ try, ‘Can we shorten this method?’ By changing the language to be inclusive, we show that we are on the same team,” he concluded.

Inevitably, either in meetings or instant messaging threads, situations can go sideways with the potential to blow up. In these instances, Caswell has a personal rule: “I take the conversation out of the code review and right to the developer’s desk.” Sometimes there’s no substitute for a one-on-one conversation.

Read the entire interview with Verifi Software Engineer, Taylor Caswell, here.

See why Verifi is a great place to work. Check out our profile on Built In LA here.

Although the holiday shopping season starts earlier every year, the transaction frenzy really begins with the sales juggernaut of Black Friday and Cyber Monday. According to an Adobe Analytics survey, 70% of responding U.S. consumers planned to shop over this year’s four-day period beginning the day after Thanksgiving. For the second year in a row, Cyber Monday edged out Black Friday as the “go to” day for online deals, with almost 10%* more respondents preferring holiday-time shopping on the one day most workers normally dread.

‘Tis the Season for Big Numbers

As one might expect, the number of online holiday transactions continues to grow along with the dollar volume per transaction, peaking during Black Friday/Cyber Monday. With increasing sales continuing until the following Friday, the term “Cyber Week” is gaining traction. Since Thanksgiving is falling a week later than last year, the shopping during this period is expected to be especially heavy.

Per the Adobe Analytics survey, current sales estimates for the holiday period, Nov 1 – Dec 31, put digital dollar volume for domestic spending at $143B, with an estimated $9.4B attributed to Cyber Monday alone.

In this whirlwind of holiday transactions and distractions, you can be sure there’s likely to be a stormy fraud season as well. Add fraud and disputes into the mix of the happiness and merriment, and the hard-earned revenue of the season can be somewhat eclipsed, leaving businesses with a case of the holiday chargeback blues.

Maintaining Due Diligence in a Transaction Tornado

As a merchant, how can you mitigate fraud risk and provide your best customer experience, while processing many times the transactions of an average day? It’s a delicate balancing act, to say the least. With stringent fraud detection in place, a merchant can still be subject to false-positives and declined valid sales. With loose fraud prevention, merchants can let fraudsters through and soon find themselves in a deluge of disputes and losses.

Historically, many holiday transactions may come from new customers with no history of patronizing your business. Now is the time to shore up your fraud and chargeback prevention program – and even expand your client base in the process.

Multi-Layered Fraud Prevention

Consider these solutions and best practices to ensure risk reduction and help build customer loyalty by providing a secure buying experience.

- IP intelligence. Deep analysis of the IP Address used for the transaction to monitor possible risks associated with the location.

- Device fingerprinting. Identifies devices that attempt multiple transactions to the same merchant and make it look like they came from different IP addresses.

- Address Verification Service (AVS). Verifies the address connected to the cardholder using a comparison look-up.

- 3D Secure. Uses a three-domain model to validate credit and debit card purchases.

- Account and card information is replaced with an encrypted, one-time token identifier.

- The location of the cardholder and the customer are compared.

- Secure Sockets Layer (SSL). Provides a secure encrypted communication between customer devices and websites where sensitive information is input.

- Merchant Co-Op. Transactions are compared against a list of orders, looking for matches with fraudulent accounts.

- Monitor express shipping transactions. Fraudsters exploit this delivery type to receive goods before fraud can be detected.

An Easy Way to Reduce Chargebacks

It’s fair to think many purchases made during this time of the year will be given as gifts. Sometimes the people who receive these gifts can’t use them, or don’t like them, and will want to return them. So, in order to help keep chargebacks from popping up like mushrooms, ensure that your return policy is clearly posted and acknowledged. This will not only reduce disputes but support a hassle-free return experience and maybe garner some new customers.

Return Policy Suggestions

- Implement a longer return/refund window. Consider using a more lax return/refund policy duration for holiday purchases.

- 24/7 customer service. Maintain extended customer service staffing and hours for the duration of the extended return/refund policy. Encourage customers to contact customer service with any problems.

- Proactive communication. Follow-up with customers who made purchases during the holidays. Remind them of the extended return/refund policy and provide the customer service contact information.

- Wiggle room. Merchants who allow their customer service team to use their best judgement with returns/refunds may experience greater customer satisfaction and brand loyalty. Trust the customer service team to be flexible with the rules when it makes sense – especially if a chargeback is the only other option for the customer.

- Promote your return/refund policy. Merchants would do well to promote their post-holiday return/refund policy just as they promoted their Black Friday and Cyber Monday sales.

With a little upfront preparation and diligent monitoring, you can look back with a grin on successful holiday sales, instead of putting “do something about chargebacks” on your New Year’s resolution list and singing the “Holiday Chargeback Blues.”

Using Your Customer Data to Manage Chargebacks

Chargebacks and disputes are a part of doing business, but they don’t have to be handled at the cost of doing business. Most merchants already have the tools to prevent disputes and recover losses from chargebacks, and all it takes is a little strategy and time to protect and recover revenue.

To win any case, whether in court or a payments dispute, you need facts. Merchants have access to an arsenal of transaction and customer facts in their CRM and receipt data. It’s just a matter of knowing what data are required to recover lost revenue and for what type of chargeback.

Understanding the Chargebacks Affecting Your Business

The types of chargebacks you receive can be based on how you do business and/or what type of business you’re in. For instance, a subscription-based company will see a lot of Cancelled Recurring chargebacks because customers will file a chargeback with their card-issuing bank rather than just calling the merchant to cancel their subscription. An example of chargebacks based on how a merchant does business would be Credit Not Processed. This happens when a customer returns a purchase and does not receive a refund or response from the merchant. The main point being, don’t avoid chargebacks and let them pass their freshness date sitting on your desk, resulting in lost revenue. There’s a lot to be learned and money to be reclaimed if you address and fight chargebacks.

Addressing Chargebacks with Factual Data

Of course, both of the above chargeback examples can be won if the merchant can prove proper protocols were followed. The goal is not handing over great data volume, it’s assembling relevant data as compelling evidence in a concise, effective response.

Compelling evidence for Cancelled Recurring chargeback may include:

- Proof cancellation policy was understood, signed, and accepted by the customer

- Proof policy is clearly posted on the company website with cancellation instructions

- Justification of why the subscription was not cancelled

- Proof a renewal notice sent to the customer

Compelling evidence for a Credit Not Processed chargeback may include:

- Proof customer was refunded for their purchase

- Proof customer was not entitled to a refund

- Proof customer was shown refund policy prior to purchase

- Justification why the customer was not entitled to a refund.

Some Common Reasons for Chargebacks

Below are six common reasons for chargebacks, with reason codes:

Fraud – Card Not Present

10.4 (Visa), 4387 (MasterCard), F29 (AmEx), UA02 (Discover)

Transaction Not Recognized

4863 (MasterCard), R04 (AmEx), AA (Discover).

Goods or Services Not Provided

13.1 (Visa), 4855 (MasterCard), C08 (AmEx), RG (Discover)

Not as Described or Defective Merchandise

13.3 (Visa), 4853 (MasterCard), C31 (AmEx) and RM (Discover)

Cancelled Recurring

13.2 (Visa), 4841 (MasterCard), C28 (AmEx), AP (Discover)

Credit Not Processed

13.6 (Visa), 4860 (MasterCard), C02 (AmEx), RN2 (Discover)

Important Data for Chargeback Representment

Since submitting chargeback representments is a time-sensitive process, it is most beneficial to keep data organized and ready to be put to work. Below are some of the most common data used as compelling evidence for a broad range of representments.

- Transaction information

- Receipts

- Proof of Delivery / Shipping Confirmation

- Packing Lists

- Customer Communications

- Emails

- Phone call log

- Copy of Return Policy / Terms and Conditions

- Rules for Cancelling Subscription Accounts

- Digital Download and Usage Information

Don’t forget to include a concise cover letter stating your case with every representment.

Address Chargebacks as a Part of Doing Business

Unless you address chargebacks, you’ll be victimized by them. So, take the necessary steps and prepare to win back lost revenue. Make sure you’re organized, know where your data is, and prepare to put it to work. Get familiar with the CRM software, payment gateway, customer service software, how and where your data is stored, and understand how to retrieve it.

If the issuer has a preference for how the evidence is to be presented, be sure to follow it. Also know the monetary tolerance where pursuing a chargeback representment may or may not be financially beneficial for your business.

For further information, get Verifi’s complete chargeback guide here.

Join our “Data is the New Currency” webinar to learn more about managing disputes and increasing profits. Register here.

In revised standards to technical document AN 2202 posted on the Mastercard Technical Resource Center, Mastercard has determined to impose a global mandate that may have serious implications for how you do business. This mandate applies to merchants that use a negative option billing model.

Negative option billing is the billing practice of offering a sample or “free trial” of a product or service in exchange for payment card details and account information to be billed later. Generally, these contracts and payments automatically trigger upon completion of the agreed-upon term.

An increase in complaints from regulators, issuers, and cardholders prompted Mastercard’s enforcement of new procedures to mitigate deceptive business practices.

The negative option billing model is popular among many merchant segments, notably those offering subscriptions and memberships. In the revised standards published as AN 2202 in October 2018, Mastercard focused on the nutraceutical industry, specifically identifying it as a high-risk category.

Changes for those impacted

From Verifi’s review of Mastercard’s document, we believe any business engaging in the “free trial” or negative option billing model, where there is an exchange of a physical good, may now be deemed “high risk.” Also, merchants using this billing model are required to be designated under the Merchant Category Code 5968, Direct Marketing, Continuity, Subscription Services. Acquirers are required to register physical goods merchants using negative option billing through Mastercard’s Registration Program (MRP) to support tracking to ensure compliance. Services and digital content merchants are not currently included in these changes.

Your acquirer will work with you to execute changes in operational processes. Below is an outline of those processes, as referenced by Mastercard:

- Merchants must initiate the trial period on the date the product is received by the cardholder.

- E-commerce merchants must include the URL of the website where the cardholder initiated the purchase on their cardholder descriptor. Mail Order/Telephone Order merchants must provide a valid and easily accessible phone number.

- All recurring payments processed through the same acquirer must occur under the originating merchant ID for the initial payment.

- Following the trial, and before recurring billings begin, merchants must provide each cardholder the following information and obtain the cardholder’s explicit consent to bill the recurring payment amount:

- Payment transaction amount

- Payment date

- Merchant name and billing descriptor

- Subscription cancellation link with clear instructions

- With each attempted authorization, merchants must send a receipt to the cardholder including instructions on how to cancel the service.

- Merchants are required to provide written confirmation to the cardholder upon cancellation of a cardholder’s trial period or negative option billing plan.

- Acquirer’s must maintain transaction verification information for at least one calendar year

Verifi’s Chargeback Prevention Solutions

If you’re not already using Verifi’s chargeback suite, now is the ideal time to get started! According to a recent report by Javelin Strategy & Research, commissioned by Verifi, cardholders bypass the merchant to initiate a transaction dispute with their issuer up to 76% of the time.

With increased visibility to recurring transactions, it can be inferred that your chargeback volume may increase. Increased visibility is great in providing outstanding customer experience, but as we have witnessed, the issuer is still likely to be the first contact for cardholders to initiate a transaction dispute.

With Verifi’s Order Insight®, you can provide detailed billing descriptors as part of actual transaction data. This helps to clear up billing confusion and provide cardholders with all the details of their purchases, directed through their issuer’s online or mobile channels. This same transaction data is supplied to the issuer’s call center representatives, where trial and recurring payment amounts, terms, and consent/authorization data are reviewed with cardholders in near real-time at inquiry or dispute.

Verifi’s Cardholder Dispute Resolution Network™ (CDRN®) keeps you protected. Our patented closed-loop network provides you the opportunity to resolve transaction disputes directly with cardholders, rather than involving your acquirer or any card brand.

What’s Next

Mastercard will begin enforcing these operational updates on April 12, 2019. We will provide any updates on these changes as they become available from Mastercard.