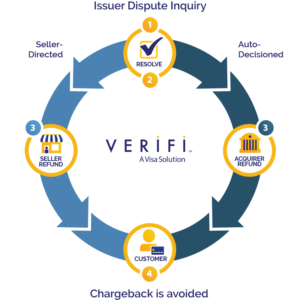

Every once in a while, existing technology is reformed in a way that produces a game-changing innovation. Such is the case with Rapid Dispute Resolution (RDR), Verifi’s new service to quickly resolve transaction disputes. RDR increases the global reach for Verifi’s RESOLVE solution, but also auto-decisions disputes and automatically issues a customer refund, effectively resolving confirmed disputes in real time, well before they escalate.

A Very Appropriate Name

As part of Verifi’s RESOLVE solution, RDR complements the existing CDRN® service to build on Verifi’s current wide-reaching dispute coverage. The key difference is the CDRN service handles most major card brands through participating CDRN issuers and is completely driven by the seller, including dispute review, decisioning and seller-initiated refund, all within a 72-hour window. Whereas the RDR service handles Visa disputes through participating RDR issuers with immediate decisioning results, requiring only the initial rule definitions directed by the seller.

Play by the Rules. Yours.

The inner workings of RDR are simple genius. By utilizing automated decisioning running seller-defined rules and parameters, the RDR service can auto-resolve disputes and instruct the acquiring bank to immediately issue a customer refund – delivering precise, clockwork results every time.

The rules and parameters input by the seller are what determine the decline or acceptance of dispute liability, and triggers an automated customer refund when liability is accepted. Those disputes declined by the decision engine are sent into the established dispute process.

[su_row][su_column size=”1/2″ center=”no” class=””]

Seller-defined rule parameters below:

Rule elements seller can define:

- Issuer BIN

- Transaction Date

- Transaction Amount

- Transaction Currency Code

- Purchase Identifier

- Dispute Category

- Dispute Condition Code

[/su_column]

[su_column size=”1/2″ center=”no” class=””]

Examples:

A.) IF Purchase BIN is (123 OR 456 OR 789) then ACCEPT

B.) IF Purchase Identifier is <blank> then ACCEPT

C.) IF Transaction Currency Code NOT EQUAL TO USD then ACCEPT

[/su_column][/su_row]

How RDR and CDRN Work Together

The combination of RESOLVE services brings expanded global reach to sellers participating in both RDR and CDRN. Although these services are essentially a means to the same outcome, the method by which the outcome is reached differs greatly; but this is what makes them complementary to one another. Since RDR is completely automated, the seller’s internal operations are free from the dispute review task and initiation of a reversal. This relieves seller operations completely in the case of RDR disputes to focus on core business issues. Adoption of RDR folds right into sellers’ current CDRN agreement, and there will be no change to pricing structure. Current CDRN participants just need to sign the contract addendum below.

[su_row][su_column size=”1/2″ center=”no” class=””]

1.Customer contacts issuer with a trans action dispute

2. Dispute is routed to the RESOLVE solution

3.

Multi-Card Brand Disputes:

Dispute paused by issuer for seller-directed resolution

3.

Visa RDR Disputes:

Participating RDR issuer directs dispute through decision engine for automatic resolution

4. Customer dispute resolved

Although RDR dispute volume and outcomes will be visible on the MyCDRN, the two RESOLVE services reside on different platforms on the issuer-side. The two platforms share critical communications, preventing a dispute from being processed twice, eliminating the possibility of future false positives.

[/su_column] [su_column size=”1/2″ center=”no” class=””]

[/su_column][/su_row]

[/su_column][/su_row]

How to Participate in RDR

Participation in the RDR service is neither automatic nor mandatory. To sign up, please reach out to your relationship manager or

click here

. Following sign up, you will be sent the rule parameters to populate with your information. This information will then be input into the system prior to

RDR release in April 2020

.