Sellers, especially those operating in a card-not-present environment, have seen increased instances of fraud over the last few years. Between 2019 and 2021, annual Visa CNP sales grew 51% and disputes grew nearly 30% globally1. Many of these disputes are thought to be inaccurately categorized as fraudulent and may truly be the result of friendly fraud, or more appropriately named first-party misuse. Visa’s upcoming Compelling Evidence 3.0 (CE3.0) initiative seeks to ‘level the playing field’ to create a fairer ecosystem for sellers, issuers, and cardholders.

History of Compelling Evidence changes to address Visa fraud disputes

2013

Using data to help specify fraud transactions introduced as evidence (device information)

2016

Visa Merchant Purchase Inquiry (VMPI) launches, as well as digital receipt support

2016

Verifi Order Insight® launches

2019

Visa acquires Verifi and the companies combine capabilities, including a strengthened Order Insight product.

2020

Most Visa issuers were mandated to receive Order Insight data & encouraged to use in the dispute intake process

The most recent change was announced in June 2022 indicating that additional protections from illegitimate disputes will be made available for sellers when specific qualification criteria are met.

What are the Qualification Criteria?

Not all disputes will qualify as CE3.0 protected disputes. Visa collected feedback from several sellers and issuers as proof of concept before announcing the details of this initiative. Collaboration between all parties is important to ensure a standardized set of data is collected from the seller and provided to the issuer for purposes of defining the purchasing relationship between the cardholder and the seller.

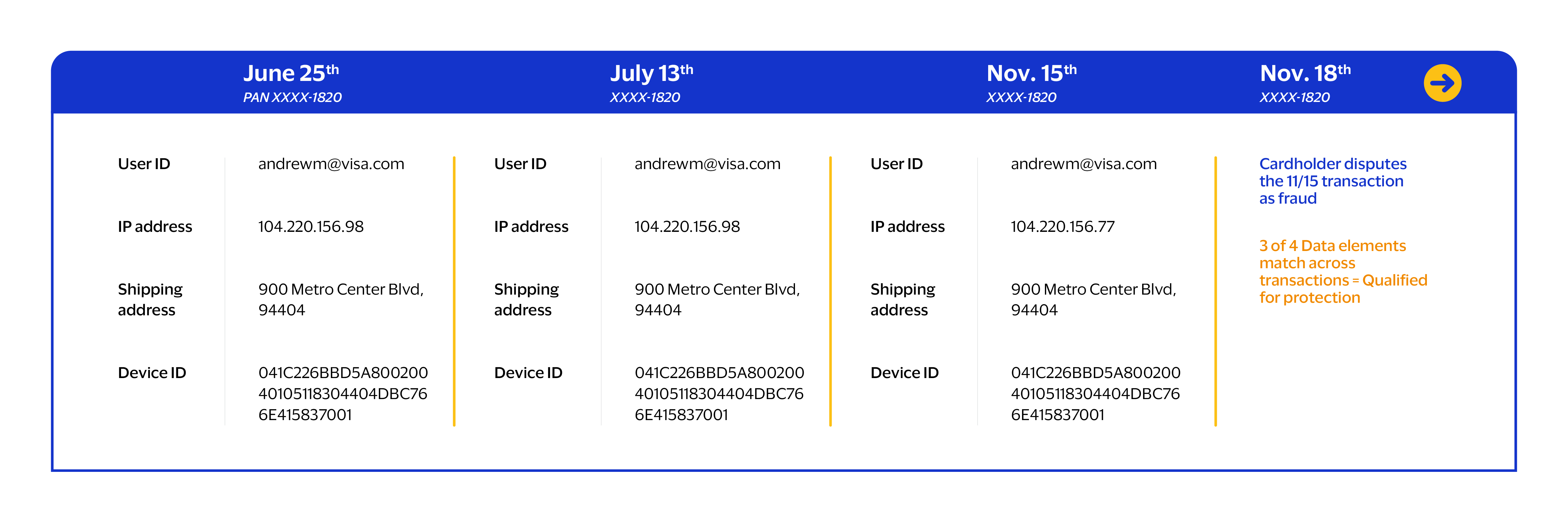

CE3.0 protection, first and foremost, only applies to Visa disputes that are categorized as 10.4 Other Fraud—Card Absent Environment. To protect sellers from false fraud claims from disputes and pre-disputes with 10.4 reason codes, a seller must establish and provide details of a pattern of prior, legitimate transaction history to help prove the cardholder participated in the transaction in question and it should not be deemed fraudulent.

Qualification Criteria:

- Minimum of two transactions on the same payment method that settled at least 120 days prior to the dispute date. Transactions previously disputed as fraud are not eligible.

- At least two of the core data elements match between prior transactions and the disputed transaction and one of the two must be either IP address or Device ID.

Core Data Elements:

- User ID

- IP Address

- Shipping Address

- Device ID

An example of a dispute with qualifying criteria to meet CE3.0 protection requirements can be found below:

How Can Sellers Take Advantage of CE3.0

Pre-dispute

Facilitated through Verifi’s Order Insight solution, participating sellers can provide purchase details to issuers in an attempt to deflect a transaction in question (pre-dispute) from becoming a chargeback.

How it Works

Visa will pre-select 2 to 5 transactions with no active fraud reports or fraud disputes that occurred between 120 and 365 days of the attempted dispute date.

The participating seller will need to systematically return data elements outlined in the above referenced qualification criteria for those transactions that were pre-selected.

Verifi’s Order Insight will validate the data, and pass to Visa to make the liability decision based on qualification criteria.

If criteria are met, the pre-dispute will be blocked and liability for the transaction will stay with the issuer.

Post-dispute

Aligning with the existing pre-arbitration process, sellers will have the opportunity to work with their acquirer to submit transaction data elements that meet CE3.0 qualification criteria in an attempt to recoup revenue lost to illegitimate fraud disputes (Visa 10.4).

How it Works

Seller will work with their acquirer to locate and package data elements that meet CE3.0 qualification criteria for two historical transactions that occurred 120 – 365 days prior to the dispute date for the same cardholder (identical PAN).

The acquirer will deliver the response package via Visa Resolve Online (VROL) where the CE3.0 data elements will be validated.

If the data elements from the historical transactions meet the qualification criteria, the seller/acquirer response will be deemed successful.

Benefits for seller transactions that meet qualification criteria:

- Liability shifted to the issuer

- Dispute deflection – no illegitimate fraud disputes

- Fraud AND dispute ratios not impacted

- Seller to retain revenue from the sale

- Seller not liable for dispute costs, fees, or fines – and reduces operational costs

What’s Next?

The updates to the post-dispute/pre-arbitration flows will begin in April of 2023. Pre-dispute updates facilitated through Order Insight are expected to be available shortly after.

In the interim, Verifi and Visa recommend that sellers begin to locate in their systems the CE3.0 data elements to meet qualification, and ensure data is securely stored for the specified time frames.

More details on this exciting initiative will be available on September 15, 2022 as part of Verifi’s webinar, Removing the Noise from the Dispute Ecosystem. Register here.

1 Visa Internal Reporting, 2022