COVID-19 Risk Management Impacts and Tips for Sellers

Shelter-in-place orders and mandatory lockdowns have shifted consumer behavior significantly. Not only are consumers largely restricted from leaving their homes, preventing them from visiting stand-alone businesses and shopping centers, but state and regional mandates are forcing non-essential retailers to remain closed during lockdowns. As a result, consumers have turned to e-commerce, m-commerce, and third-party marketplaces for their shopping needs. In fact, a 2020 Remote Payments Study reports a 34.9% increase in online retail purchases year-over-year. As authorizations rise, a similar rise in disputes is likely to follow. Sellers must be prepared for the volume increase in both areas.

Increased online shopping activity has resulted in strained operations for many sellers. Departments like customer service and shipping have been impacted heavily by this spike in demand. Compounding this issue are shelter-in-place orders that prevent workers from performing their duties due to their non-essential status. As a result, two-day shipping may turn into two-week shipping, or logistics may begin to lose track of packages amidst the influx of orders.

Theft will also be a factor. According to a 2018 study, 15% of all deliveries in urban areas do not reach customers on the first attempt. In fact, in New York City alone, over 90,000 packages are stolen or go missing every day. With more people concentrated in urban and residential areas during a time of reduced access to ordinary resources, numbers could soar. As unemployment rises due to COVID-19, sellers can expect an increase in unconfirmed deliveries and complaints.

Customers whose expectations for delivery aren’t met and who can’t track their purchases are likely to file a dispute rather than contact the retailer. In fact, up to 76% of all customers bypass the seller with a dispute, according to “The Chargeback Triangle” from Javelin Strategy & Research, commissioned by Verifi. Unfortunately, seller personnel responsible for payments and dispute management may not be available due to furlough or layoff. One company that provides events organization services has a single person dedicated to fighting chargebacks. In such a situation, sellers should consider outsourcing dispute management to lower their risk profile.

Mitigating the Risk – Best Practices

Communication is key for the success of any relationship, and that remains true between sellers and their customers. Whether the seller provides finished goods or services, customers want to be informed about how their experience might be impeded by COVID-19 impacts. As such, many businesses have provided pre-transaction communications to help assure their customers’ satisfaction. For example, Amazon posts a message at checkout that delivery times may take longer than usual, which can help to align customer expectations due to possible strain in delivery channels. In the same vein, extra post-transaction communication can also help improve the customer journey and prevent disputes.

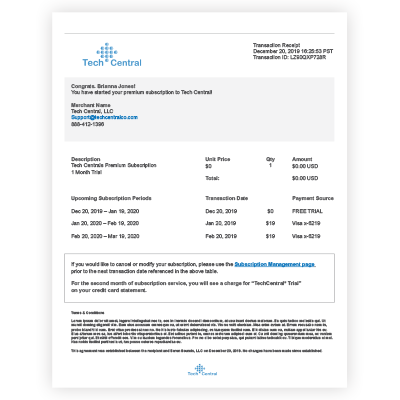

The purchase confirmation email is a powerful tool for providing clear communication to the customer. In the email, sellers can include return and refund policies as well as links to terms and conditions. If the provided service is subscription-based, then the email can include specific details regarding subscription terms and clear instructions on how to opt out. Finally, if physical goods are being delivered, then including shipping and tracking information is a sensible way to keep the customer informed and confident about the pending receipt of their purchase.

In a recent interview, successful entrepreneur Mark Cuban said, “…I want to do everything via email because that allows me to go back and look something up.” Since a purchase confirmation email is transactional, the customer cannot opt out and must receive the communication. As a result, assuming the email has all of the pertinent information, it can be a persuasive and compelling document in a dispute representment case.

Communicate Service Level Agreements

The novel coronavirus is creating unexpected demands and challenges for e-commerce businesses. Sellers may need to adjust their service level agreements and reset expectations of return and refund policies. In such cases, sellers should communicate those changes as early and as visibly as possible via email, website updates, and in-store signage.

Sellers need to be flexible in this uncertain time. To that end, dispensing customer credit vouchers is a savvy way to help mitigate increasing dispute volume. Customers who know that they will use a seller’s services in the future when they become available again may welcome having the credit – especially if the seller is willing to attach a loyalty discount. Extending return and refund periods or loosening the terms are other good methods to reduce friction for the customer. Whatever changes the seller makes, it’s always important to be proactive in communication of those changes.

Despite a seller’s best efforts, some disputes will escalate into chargebacks. Successful representment relies on adequate documentation in order to build compelling evidence. Four actions sellers can take to protect themselves include:

- Maintaining CRM/Transaction Data: Sellers should keep detailed records on customer purchasing history and communications during the transaction process.

- Record Subscription Policy Agreements: Sellers must record the time and date a customer agreed to a subscription policy in case the customer denies having been presented it.

- Preserve Customer Communication and Service Logs: An archive of the customer’s interactions with the seller can be a persuasive tool in proving what the customer was aware of and consented to in agreement.

- Capture Data from Alternate Sources: In this age when communication platforms are universally accessible, customers sometimes will communicate over social media their intention to commit fraud against a seller, or inadvertently reveal proof of their use of a product or service later contested. Other times, the customer will work with a seller’s customer service via social media. In either case, it’s important to consider social media platforms as a source for compelling evidence for representment.

Collaboration and Communication for Risk Mitigation

While fraud prevention and other risk management tools used at authorization can help ensure sellers protect their revenue, as well as customer loyalty, data-sharing collaborative solutions serve as the best measure to prevent disputes from entering the payment ecosystem. Such innovative SaaS solutions help protect sellers, acquirers, and issuers alike from the operations-obstructing and damaging costs of disputes.

Since 2005, Verifi has been leading the payment industry in disputes management services. Now, more than ever, these solutions can help protect sellers’ brands in current and possible future disputes surges.

PREVENT: Enables sellers to share contact information and transaction data on our secure global data network directly with issuers to deflect unwarranted disputes and identify friendly fraud.

RESOLVE: Empowers sellers to resolve disputes before they are filed by the issuer and escalate to costly chargebacks. Rapid Dispute Resolution (RDR) will provide automatic dispute resolution via a decision engine with customized rules set by the individual seller.

RECOVER: Our team of specialists perform representment services to businesses of all sizes, in a wide variety of industries. Our experts do all the work on behalf of our seller partners, determining the best approach to suit specific business needs to maximize revenue recovery.

Verifi’s suite of dispute mitigation solutions can significantly reduce the impact of dispute spikes due to increases in online purchasing, as a result of shelter-in-place restrictions. Verifi’s PREVENT extends seller customer service by enabling issuers to share detailed transaction information at customer inquiry, as well as delivering order data direct to customers via online and mobile banking apps for customer self-resolution. Verifi’s RESOLVE solution provides direct communication between issuers and sellers on confirmed disputes, allowing sellers to resolve a dispute before it escalates into a chargeback. As COVID-19 may continue to increase dispute volume, Verifi’s robust and evolving solutions are well-equipped to manage it – preventing operational drain on strained resources and improving customer experience.

Check back here for Verifi’s next installment of our ongoing series.

Reference

2020 Remote Payments Study – Pyments.com

The Final 50 Feet Urban Goods Delivery System: Common Carrier Locker Pilot Test at the Seattle Municipal Tower – University of Washington

90,000 Packages Disappear Daily in N.Y.C. Is Help on the Way? – The New York Times

The Chargeback Triangle – Verifi

Chargebacks and Coronavirus – RunSignUp