More Than a Call Center – The Digital Experience of Order Insight

Since the introduction of Order Insight in 2016, Verifi has built a strong network of sellers and issuers with the goal of establishing a global data-sharing network to prevent unnecessary disputes. Key milestones – like the acquisition of Verifi by Visa – have played a major role in the expanding adoption of our solution. Soon, we’ll be announcing expanded issuer participation through mobile and online applications! This digital experience will provide enriched order details to your customers to increase data transparency and expand sellers’ protection against unnecessary disputes through multiple channels. By enabling issuers to deliver essential seller and transaction details via online or mobile banking apps, your customers can access order data when they want and where they want, gaining an improved post-purchase experience.

Customers’ Changing Needs

Sellers have a vested interest in providing customers easy access to purchase details, and not just for customer convenience. Since as many as 76% of customers bypass the seller and go directly to their issuer with transaction inquiries, increased purchase transparency can help reduce disputes

1

.

Providing transparency to purchase details at the two most common dispute entry can reduce disputes – and improve your consumer’s experience:

- Digital Experience: Customer access to online or mobile banking details

- Call Center Experience: At the point of issuer dispute in-take

Let’s explore how Order Insight enhances seller and customer experiences in both scenarios.

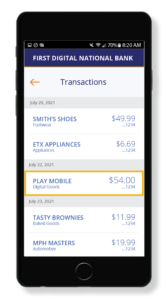

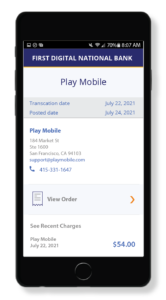

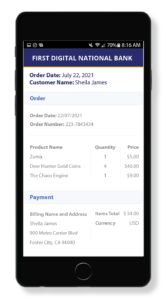

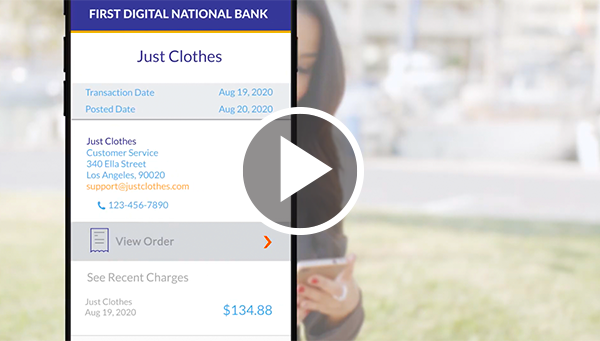

Cardholder Digital Experience from Order Insight

What Is It?

Receipt Data/Details

The Order Insight Digital Experience is an innovative approach to data-sharing. With immediate access through their issuer’s online banking or mobile banking applications, consumers can view and validate purchase details, allowing them to self-serve where they want and when they want. This reduces phone calls and emails to sellers and issuers, lessening operational effort and expense, while reducing friendly fraud commonly caused by consumer confusion.

Click to see enlarged images >

Sellers can choose from a variety of data elements, including:

- Seller Name

- Seller Phone Number

- Seller Website

- Seller Email Address

- Transaction Total

- Transaction Currency

- Order Date

- Order Number

- Customer Name

- Item Description

- Item Quantity

- Item Price

- Tracking Number

- Credit Date

…among others

Call Center Experience for Consumers from Order Insight

What Is It?

The Order Insight call center experience has been around since 2016 and is the experience that many sellers leverage today. With Order Insight, a global network of participating issuers has prompt access to detailed seller and transaction receipt data to help validate purchase details. This validation helps to prevent unnecessary disputes at call center inquiry.

Evolution of Order Insight with the digital experience

Order Insight clients can expect to see an increase to their total volume of Order Insight inquiries as issuers ramp participation via online and mobile banking apps. Due to the self-serve nature of the digital experience, we anticipate the volume of inquiries to steadily increase with the ratio of digital inquiries eventually outpacing those of the call center.

Transparency is the answer

By providing an environment for consumers to self-serve, the intended outcome is a reduction in disputes and inquiries to both seller and issuer customer service centers. Greater transaction transparency may equate to a reduction of operational expenses, dispute losses, and an enhanced post-purchase experience for consumers.