Get the merchant services you need to ensure comprehensive and balanced fraud management.

Take advantage of Verifi’s Intelligence Suite™ to mitigate payment fraud threats with one simple-to-use solution.

You are in the business of selling products and services. Verifi is in the business of making sure that your business and accounts avoid payment fraud and are protected. We are your partner in comprehensive and layered end-to-end fraud protection and payment risk management.

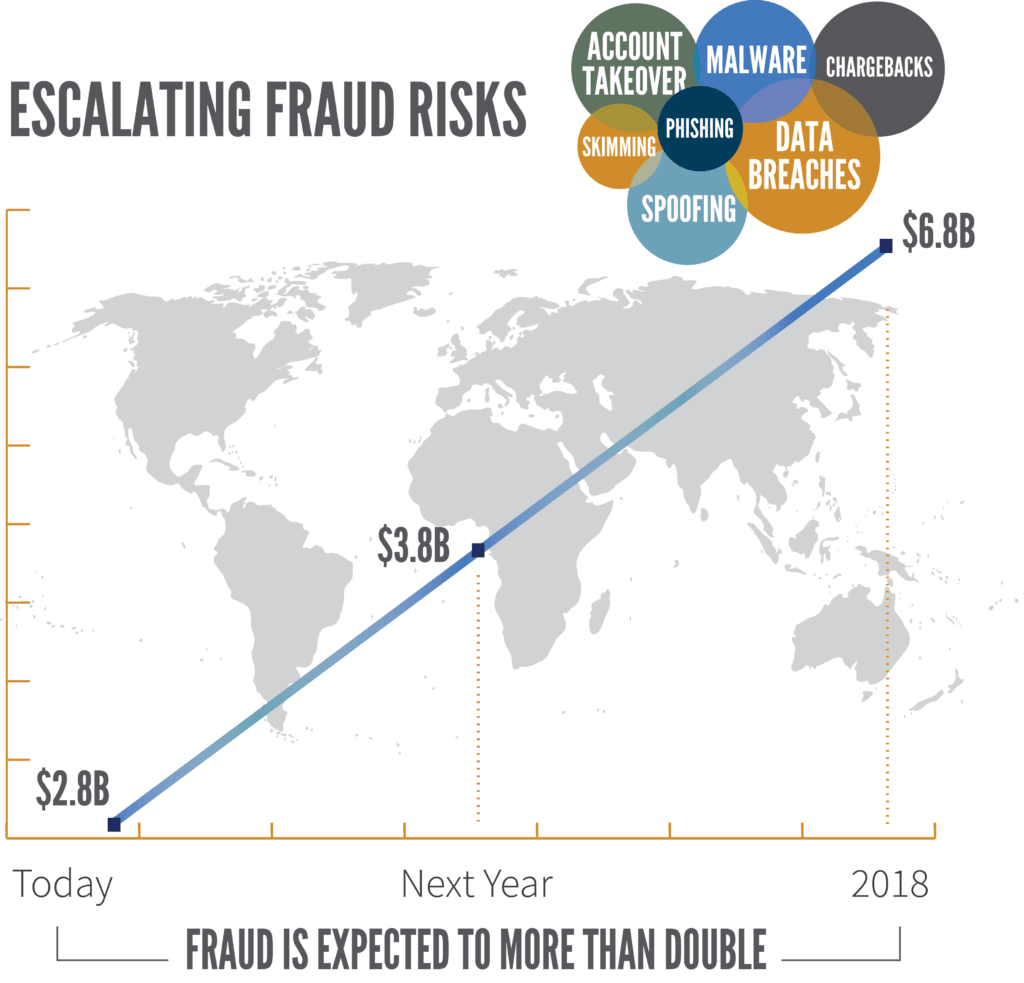

You know the cost of doing business. From idea creation, production, employee costs, inventory costs, and infrastructure – it’s not easy to manage cashflow and keep moving forward. The last thing you need to be dealing with is the impact that fraud can have on your accounts. Many merchants underestimate the real cost of fraud.

For every dollar stolen, through chargebacks can cost you a total of 2.40% in lost time, revenue, services, and merchandise.

Many merchants incorrectly assume that the new online buying convenience makes it easier for them to be protected and secure. This is not the case. With constantly changing payment technologies, it’s impossible for you to stay current and aware of the exposure and risk these options pose to your business.

This is why you need to take advantage of Verifi’s merchant services, including our fraud defense solutions. We recognize that fraud protection measures must walk a fine line of not being overly restrictive. Misplaced or rigid fraud measures result in false positives and a lengthy manual review process that drain resources and create unnecessary frustration for your customers during the checkout process.

Up to 97% of transactions flagged as high-risk can be legitimate sales that are lost due to overly restrictive fraud measures.

Effective Fraud Protection

There is an unlimited number of fraud protection tools available to you. How do you choose the tools that will work properly for your business?