Dispute representment, the process of responding to chargebacks to recover revenue, places significant demand on merchants’ internal resources. The process can be time-consuming and costly, where directing expenses on staff, information gathering, and communications with multiple parties would be better directed toward product and service development to grow a greater customer base. Fortunately, Verifi’s chargeback mitigation pre-dispute solutions can help merchants avoid representments and even turn transaction disputes into opportunities to strengthen customer relationships.

Representing Disputes is Difficult

Representing a dispute is always a net loss. Even if a merchant recovers 100% of the transaction, the payment dispute has already impacted their dispute ratio with the card brand. Additionally, most merchants aren’t experts in dispute representment, and they may not be prepared for the amount of time and effort it takes to actually win a representment case. Below are some of the common challenges a merchant could face:

Collecting Documentation

Each chargeback comes with its own documentation requirements. Staying on top of reason or condition code details requires an informed staff. Collection of some key documents for chargeback responses includes:

- Proof of delivery, signed receipt for goods

- Proof that the cardholder’s CVV was provided

- Refund/return policy (all issuers require proof that your return/refund policy is clearly visible throughout the sales process)

- All documented customer communications

Time Constraint

The customer has up to 120 days to file a chargeback from the transaction’s posting date. Merchants, however, have a maximum of 30 days from the date of the chargeback – not from the date of notification – to respond with representment. In the time it takes for merchants to learn of the chargeback and assemble an effective representment, merchants may have 14 days or less to respond to the chargeback.

Communication Breakdown

Merchants may discover that they have been preparing a case for a chargeback that their acquirer is already managing. For example, there may be times when the acquirer decides to push back against the chargeback, without informing merchant clients.

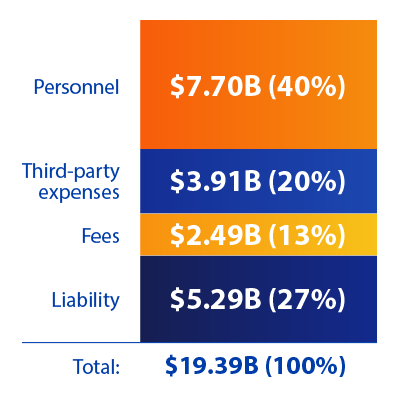

In 2018 alone, merchants experienced $19.39 billion in costs for chargeback management1.

While chargebacks do cause losses in revenue, for some merchants, time may be the greatest cost when managing disputes and chargebacks. If that’s the case, then the expense is made at otherwise growing their customer base and loyalty.

Keeping Up with Payment Options

Evolving payment technologies provide quick, convenient purchasing options for customers, creating expectations for lightning-speed payment acceptance. Advances in streamlined payments could be the driving force behind customer expectation for a quick, if not immediate, solution to their disputed transaction.

Customers benefit from speedy payment options, yet merchants are still slowed by complex and tedious dispute handling processes. Today’s merchants need proactive solutions to minimize the cost and resource drain caused by disputes, while functioning at the earliest possible stage in the post-transaction environment.

Pre-Dispute Solutions

Merchants owe it to themselves – and their customers – to deploy quick-acting chargeback prevention services as an essential feature of customer service at the endgame of the payment lifecycle. Verifi and Visa have developed technologies that enable merchants to prevent and resolve disputes at the pre-dispute stage, specifically at the point of customer inquiry with their card-issuing bank.

Furthermore, customer and issuer access to purchasing details at the point of customer inquiry could lighten the strain caused by chargeback fraud. In fact, friendly fraud-related disputes are thought to be on the rise. It has been estimated that chargebacks related to friendly fraud could set back U.S. merchants up to $15 billion in 20202.

PREVENT

Verifi’s PREVENT, featuring the services of Order Insight, formerly known as Visa Merchant Purchase Inquiry (VMPI), directly delivers transaction and merchant information to issuing banks and their cardholders. At the point of inquiry, issuer staff can access merchant transaction details and review the data with the customer. Review of this data can provide immediate clarity on transactions, reducing instances of disputes and preventing friendly fraud from escalating to an unwarranted chargeback.

Order Insight Digital enables issuers to provide transaction details to their customers in their online banking portal or mobile app. Access to the details enables customers to review clear information on otherwise confusing billing information, so they can simply resolve the situation on their own, preventing a dispute from ever occurring.

RESOLVE

Verifi’s RESOLVE enables issuers and merchants to achieve chargeback resolution at the pre-dispute stage so a chargeback will never happen. RESOLVE comprises two solutions that enable merchants to provide a quick credit and prevent chargebacks.

- Rapid Dispute Resolution (RDR) gives merchants the power to define rules for immediate resolution when a Visa dispute is submitted by participating issuers in Visa Resolve Online (VROL).

- Cardholder Dispute Resolution Network (CDRN) empowers merchants to resolve disputes submitted on all other major card brands. Merchants receive notifications from participating issuers and have up to 72 hours to resolve a dispute and stop the chargeback process from ever happening.

Best of all, with PREVENT and RESOLVE solutions, inquiries and dispute submissions that are addressed at the pre-dispute stage will not count against a merchant’s dispute ratio. And because of Visa’s global presence, merchants and issuers worldwide can take advantage of these solutions to maximize their resources and provide a quick and satisfying experience for their customers.

Post-Dispute Customer Communication

Verifi’s pre-dispute solutions serve as great tools for merchants to provide better service for their customers. Even when a transaction is concluded, the merchant-customer relationship doesn’t end. Following a prevented or resolved dispute, merchants should take advantage of the opportunity to further nurture customer engagement and loyalty.

Considerations for post-dispute customer communication:

- Email or phone your customer, acknowledging the resolved dispute, and provide a reassuring message on the importance of their ongoing patronage.

- Invite your customer to enter a higher level in your loyalty program

- Extend the range of free trial offers

- Provide alternatives to the disputed products or services

- Invite their participation in a survey to provide suggestions on improving your service – and reinforce with complimentary products/services

- Include customer service contact information to support a quick response to any future purchase issues

Taking advantage of every opportunity to build and grow customer loyalty should be a key element in a merchant’s plan for core growth.

Verifi’s pre-dispute chargeback management services enable merchants to take advantage of the new standards of quick and streamlined purchasing options, by extending customer service into the post-transaction environment. Not only do merchants win by reducing resource demands for dispute and chargeback management, but your customers win as well with your assurance of their importance by providing quick and complete dispute solutions.

To learn more about Verifi’s pre-dispute solutions, contact us today.

1 “The Chargeback Triangle” – Javelin Strategy & Research, 2018

2 Merchant Chargebacks Are on the Rise due to Friendly Fraud – Mercator Advisory Group, 2019