Total Dispute Management

For Issuers

PREVENT

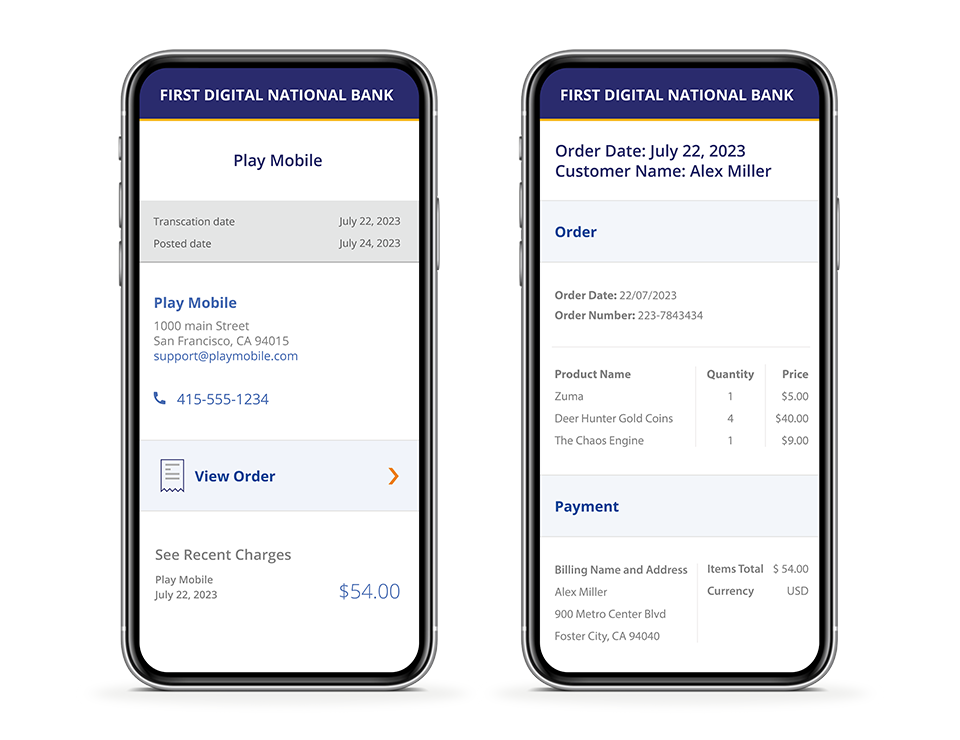

Order Insight® Digital

Self-service online and mobile banking

Enhanced merchant detail

Real-time receipt detail

Transformed digital banking experience

RESOLVE

CDRN®

Expansive merchant network

Expedited resolution of Visa and non-Visa inquiries

Online portal or batch capabilities

Integrated with issuer platforms

Improved Cardholder

Experience

Provide real-time visibility to receipt-level transaction detail and achieve one call resolution.

Reduce Submission Fees

Fewer inquiries from transaction transparency may lead to lower disputes. Our pre-dispute solutions occur prior to card brand review.

Operational Excellence

Drive down call center and investigations costs. Save time with the ability to submit both Visa and Non-Visa pre-dispute cases through a single platform.

Quicker Dispute

Resolution

Obtain expedited resolution within 72-hours for both Visa and non-Visa pre-disputes.

Stand out in the digital crowd

Improve the cardholder experience by providing digital receipt-level detail to:

- Help cardholders remember their purchases

- Clarify confusing billing descriptors

- Validate sales, rather than initiating disputes

Order Insight Digital In Action

See how collaboration and data sharing in the dispute ecosystem to allow merchants and issuers to prevent disputes before they become chargebacks

Watch Video >

RESOLVE Solution

Find the pre-dispute opportunity zone! With Verifi’s RESOLVE solution, issuers can achieve quicker resolution and decrease inbound dispute volumes.

See How it Works >