Blog | Industry Insights

-

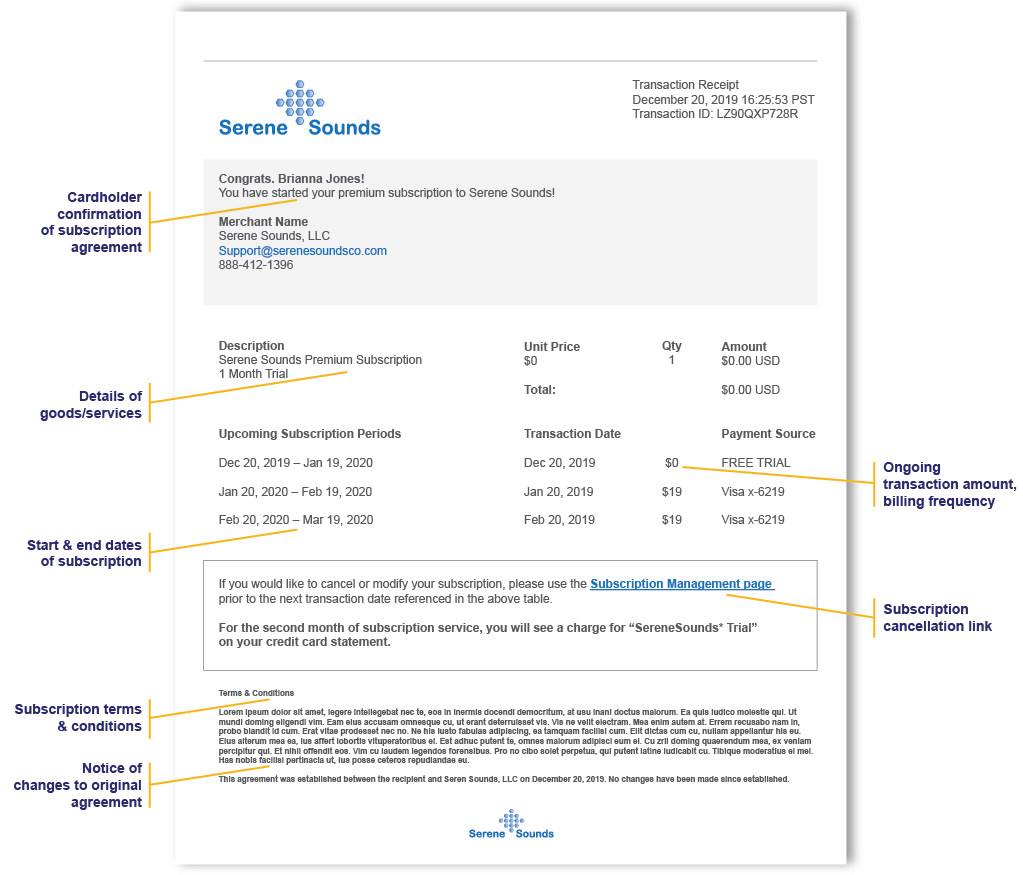

Jogging a Customer’s Memory to Prevent Friendly Fraud

The very thing that makes subscription services so valuable is also the driving force behind subscription-related card disputes. Recurring transactions are inherently structured to provide ease so consumers don’t have to remember to make payments. But when service is so streamlined, consumers can either forget what the charge is for when looking at their billing…

-

Compelling Evidence 3.0 301 Training: Qualified Transaction Matching

Visa’s new compelling evidence 3.0 (CE3.0) takes effect this April 15th, 2023. Here’s what you need to know. What is CE3.0? Visa’s latest evolution of compelling evidence requirements for 10.4 fraud disputes, designed to help reduce first-party misuse (friendly fraud) in the post-purchase ecosystem. How to Use Verifi’s Order Insight with CE3.0 In the months…

-

ICYMI: Removing Disputes Has Risen to the #1 Concern for Sellers

According to a recent survey, removing disputes from the payments ecosystem has become the number one concern for sellers, with a tertiary concern of first-party-misuse1. The question is – how do you stop disputes and still do right by your customer? Research shows it’s five to twenty five times more expensive to acquire a new…

-

Visa Compelling Evidence 3.0

For Subscription Sellers Starting in April 2023, the introduction of Visa’s new Compelling Evidence 3.0 (CE3.0) may give relief for subscription sellers who have struggled with first-party misuse (friendly fraud) for years. The ease and convenience of reoccurring subscriptions is ideal for customers; but the billing model can put sellers at greater risk for friendly fraud,…

-

Compelling Evidence 3.0 (CE3.0) in the Pre-dispute and Pre-arbitration Environments

Sellers, especially those operating in a card-not-present environment, have seen increased instances of fraud over the last few years. Between 2019 and 2021, annual Visa CNP sales grew 51% and disputes grew nearly 30% globally1. Many of these disputes are thought to be inaccurately categorized as fraudulent and may truly be the result of friendly…

-

“Friendly Fraud” is on the rise. Visa’s new Compelling Evidence 3.0 aims to help merchants level the playing field.

According to Visa internal reporting, friendly fraud can account for up to 75% of all chargebacks. “Friendly fraud is not always friendly, especially from a merchant’s perspective,” said Mike Lemberger, Senior Vice President of North America Risk at Visa. The Fair Credit Billing Act of 1974 legislated the chargeback process to help protect consumers; but…

-

What Every Merchant Needs to Know About Friendly Fraud

As card-not-present transactions rise, Visa is addressing the impacts of first party misuse Fueled by the pandemic, the digital economy has grown significantly in the past two years. At Visa, we are continuously listening to and learning from all members of the payments ecosystem. What we’re hearing is that while online purchases are more seamless…

-

Transaction Disputes Rise as Supply Chain Disruptions Persist

As the pandemic winds on into its third year, waves of new virus variants continue to wreak havoc with supply chains. Firms responsible for taking goods through each step on the journey from manufacturing to customers’ doorsteps find themselves short-staffed as new restrictions take shape around the globe. Merchants are also feeling the ripple effects,…

-

Verifi CEO: Rapid Dispute Resolution Makes for ‘Cleaner’ eCommerce Ecosystem

Within any commerce ecosystem — especially in eCommerce — chargebacks seem a way of life. For merchants especially, chargebacks are a drain on time and money. Better communication between merchants and issuers, Verifi CEO Matthew Katz told PYMNTS’ Karen Webster, resolves disputes early, prevents chargebacks and ultimately improves the customer experience. The conversation came against a backdrop in which,…

-

Visa’s Verifi: Merchants Empowered by Global Expansion of Rapid Dispute Resolution

Chargebacks and disputes may be top of mind for merchants, with Black Friday and, more recently, Cyber Monday in the rearview mirror. To that end, Verifi, a Visa Solution, said in its RDR Expansion webinar in mid-November that its Rapid Dispute Resolution (RDR) decision engines, which automate dispute resolutions, could help cement better customer satisfaction with issuers…