The very thing that makes subscription services so valuable is also the driving force behind subscription-related card disputes. Recurring transactions are inherently structured to provide ease so consumers don’t have to remember to make payments. But when service is so streamlined, consumers can either forget what the charge is for when looking at their billing statement, or simply forget to cancel services — leading cardholders to file friendly fraud disputes.

Friendly fraud is not always friendly, especially from a merchant’s perspective. When most people think of fraud, they think of stolen account numbers or identity theft, but friendly fraud occurs when a consumer intentionally makes a purchase then disputes the legitimate charge in an act of chargeback fraud. It is reported that friendly fraud could account for 18% of all fraud disputes.1

Nearly 20% of consumers who have filed a chargeback have committed first-party fraud by submitting false claims in order to get their money back on legitimate purchases. In 2021, retailers lost more than 10% of their accepted merchandise returns to fraud.

These fraudulent chargebacks occur when a cardholder forgets about the service or forgets to cancel after a trial period, and they bypass the merchant and contact the issuer directly to receive a refund or solve a transaction issue. As forgotten purchases are not considered unauthorized by the cardholder, the chargebacks negatively impact merchants both in cost and time spent responding to the false claim.

Subscription-based merchants are particularly vulnerable to friendly fraud disputes.

According to the 2023 Payments & Fraud Report, 47% of merchants believe transaction confusion is the driving cause of first-party-misuse. The best way to protect against friendly fraud is transparency at each step of the purchase process — using chargeback management tools like Verifi’s Order Insight solution, which provides the customer with enhanced transaction detail, including a full digital receipt within the cardholder’s own mobile banking app.

Giving consumers transaction clarity helps prevent confusion that is all too often the driving factor in friendly fraud.

Subscription Service Tips for Friendly Fraud Prevention

Open and clear communication is key to preserving the customer-to-merchant relationship and preventing cardholders from feeling that calling their issuer is the easiest solution. To maintain transparency and convenience, subscription merchants should follow best practices.

Recognizable, Clear Transaction Descriptors

- Do include:

- Merchant name that will be recognizable by cardholders

- Merchant name on the website the merchandise or service was purchased from

- Merchant Phone Number

- Order number, dynamically if applicable

- 20 to 25 characters

- Abbreviated words and characters (ie. “&” instead of “and”)

- Avoid including:

- Legal or company registration name, if different from that which is recognizable by cardholders

- Marketing or advertising statements

- Frequent modifications to avoid compliance programs

At the Time of Enrollment

- If your service offers a free trial, clearly state the exact length of the trial.

- Get the consumer’s express consent for an ongoing subscription with automatic recurring payments.

- Make the frequency and terms of the recurring billing model very clear and ask the cardholder to agree to the terms of service by signing or clicking “accept.”

- Get proper front-end protection for the initial transaction with customer:

- IP address

- Device ID or Fingerprint

- AVS

- Delivery or Billing address

- Item Information

- Customer Account or Login ID

- Disclose all additional fees and restrictions, including any termination fees (when cancellation occurs, what date service stops).

Prior to Each Recurring Transaction

- Notify cardholders 7 days prior to the end of the free trial period. If the trial is less than 7 days, include the end date in the trial confirmation. Elements of the reminder notification:

- Confirmation of active subscription agreementStart date of subscriptionDetails of goods/servicesOngoing transaction amount, billing frequency, and date

- Simple cancellation link

- Send a recurring billing notice 24 hours in advance of the charge.

- Provide an opt-out link that ensures the customer cancellation experience is as simple as clicking an “unsubscribe” link.

Post-Purchase

- Use an enhanced descriptor when billing the credit card:

- Include terminology such as “trial ended or recurring transaction” listed in the Merchant Name field of the clearing record.

- Option to move to invoice numbers, etc. to discretionary field for subsequent bank statements and communications.

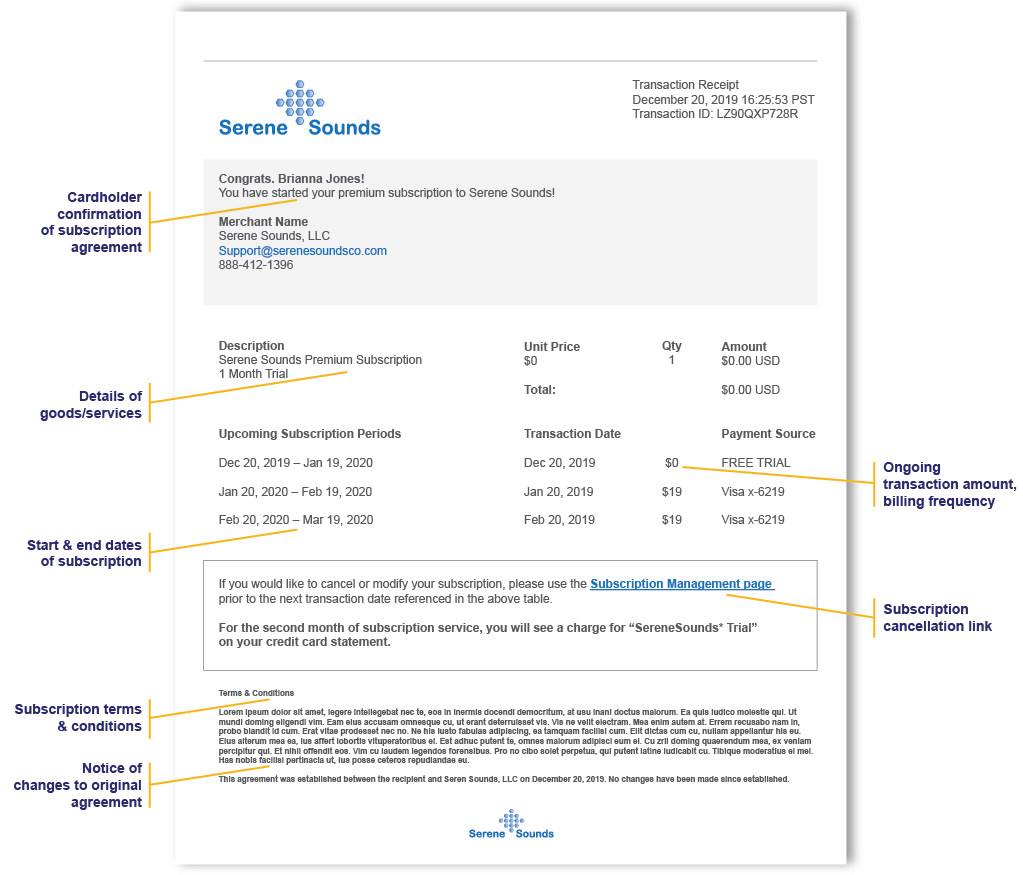

- Provide a detailed transaction receipt that shows:

- The words “Recurring Transaction” on the sales receipt near the transaction amount that will be billed.

- Cardholder confirmed agreement.

- Details of goods/services.

- Subscription start and end date.

- Ongoing transaction amount.

- Billing frequency.

- Subscription cancellation link.

- Subscription terms and conditions.

- Notice of changes to agreement.

Clear, Transparent Communications

The more information the cardholder has easily access to, the better. Do what you do best — simplify the experience for your customers by creating a transparent transaction environment for your customers.

1 https://www.verifi.com/resources/2023-fraud-and-payments-report/