Merchants, especially those operating in a card-not-present environment, have seen increased instances of fraud over the last few years. Between 2019 and 2021, annual Visa CNP sales grew 51% and chargebacks grew nearly 30% globally1. Many of these are false credit card disputes inaccurately categorized as fraudulent and may actually be the result of friendly fraud, or more appropriately named first-party misuse. Released in April of 2023, Visa’s Compelling Evidence 3.0 (CE3.0) initiative ‘levels the playing field’ to create a fairer ecosystem for merchants, issuers, and cardholders.

History of Compelling Evidence changes to address Visa fraud disputes

2013

Using data to help specify fraud transactions introduced as evidence (device information)

2016

Visa Merchant Purchase Inquiry (VMPI) launches, as well as digital receipt support

2016

Verifi Order Insight® launches

2019

Visa acquires Verifi and the companies combine capabilities, including a strengthened Order Insight product.

2020

Most Visa issuers were mandated to receive Order Insight data & encouraged to use in the dispute intake process

The most recent change occurred in April 2023, when Visa introduced additional protections from illegitimate disputes are now available for merchants when specific qualification criteria are met.

What are the Qualification Criteria?

Not all disputes will qualify as CE3.0 protected disputes. Visa collected feedback from several merchants and issuers as proof of concept before announcing the details of this initiative. Collaboration between all parties is important to ensure a standardized set of data is collected from the seller and provided to the issuer for purposes of defining the purchasing relationship between the cardholder and the merchant.

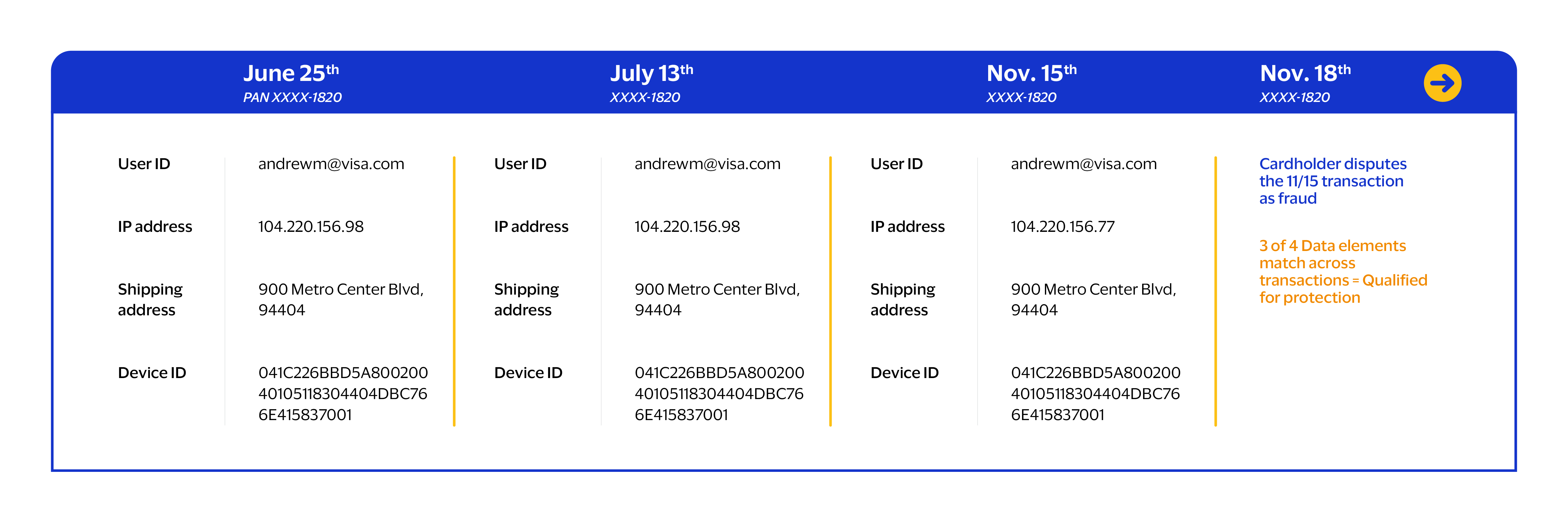

CE3.0 protection, first and foremost, only applies to Visa disputes that are categorized as 10.4 Other Fraud—Card Absent Environment. To protect merchants from false fraud claims from disputes and pre-disputes with 10.4 reason codes, a merchant must establish and provide details of a pattern of prior, legitimate transaction history to help prove the cardholder participated in the transaction in question and it should not be deemed fraudulent.

Qualification Criteria:

- Minimum of two transactions on the same payment method that settled at least 120 days prior to the dispute date. Transactions previously disputed as fraud are not eligible.

- At least two of the core data elements match between prior transactions and the disputed transaction and one of the two must be either IP address or Device ID.

Core Data Elements:

- User ID

- IP Address

- Shipping Address

- Device ID

An example of a dispute with qualifying criteria to meet CE3.0 protection requirements can be found below:

How Can Merchants Take Advantage of CE3.0

Pre-dispute

Facilitated through Verifi’s Order Insight solution, participating merchants can provide purchase details to issuers in an attempt to deflect a transaction in question (pre-dispute) from becoming a chargeback.

How it Works

Visa will pre-select 2 to 5 transactions with no active fraud reports or fraud disputes that occurred between 120 and 365 days of the attempted dispute date.

The participating merchant will need to systematically return data elements outlined in the above referenced qualification criteria for those transactions that were pre-selected.

Verifi’s Order Insight will validate the data, and pass to Visa to make the liability decision based on qualification criteria.

If criteria are met, the pre-dispute will be blocked and liability for the transaction will stay with the issuer.

Post-dispute

Aligning with the existing pre-arbitration process, merchants will have the opportunity to work with their acquirer to submit transaction data elements that meet CE3.0 qualification criteria in an attempt to recoup revenue lost to chargeback fraud disputes (for Visa 10.4 disputes).

How it Works

Merchants will work with their acquirer to locate and package data elements that meet CE3.0 qualification criteria for two historical transactions that occurred 120 – 365 days prior to the dispute date for the same cardholder (identical PAN).

The acquirer will deliver the response package via Visa Resolve Online (VROL) where the CE3.0 data elements will be validated.

If the data elements from the historical transactions meet the qualification criteria, the merchant/acquirer response will be deemed successful.

Benefits for merchants transactions that meet qualification criteria:

- Liability shifted to the issuer

- Dispute deflection – no illegitimate fraud disputes

- Fraud AND dispute ratios not impacted

- Merchant to retain revenue from the sale

- Merchant not liable for dispute costs, fees, or fines – and reduces operational costs

Automated Systematic Dispute Deflection

Verifi’s Order Insight empowers merchants to leverage the benefits of CE3.0 with automation. The Systematic Dispute Deflection feature automatically deflects confirmed first-party-misuse disputes while inquires are still in the pre-dispute stage, before a chargeback is initiated.

To learn more about how to take advantage of CE3.0, check out Removing the Noise from the Dispute Ecosystem.

1 Visa Internal Reporting, 2022