For Subscription Merchants

Starting in April 2023, the introduction of Visa’s new Compelling Evidence 3.0 (CE3.0) may give relief for subscription merchants who have struggled with first-party misuse (friendly fraud) for years. The ease and convenience of reoccurring subscriptions is ideal for customers; but the billing model can put merchants at greater risk for chargeback fraud, which accounts for up to 75% of all transaction disputes1. Friendly fraud occurs when a cardholder disputes a legitimate charge and claims it to be fraudulent.

Subscription merchants are especially prone to this form of fraud because cardholders frequently forget what service the charge is for, or fail to cancel service. Instead of contacting the seller directly, cardholders go to their issuer to dispute a valid charge.A recent study by SIFT found that nearly one in five consumers who have filed a chargeback have committed chargeback fraud by submitting false claims in order to get their money back on legitimate purchases2.

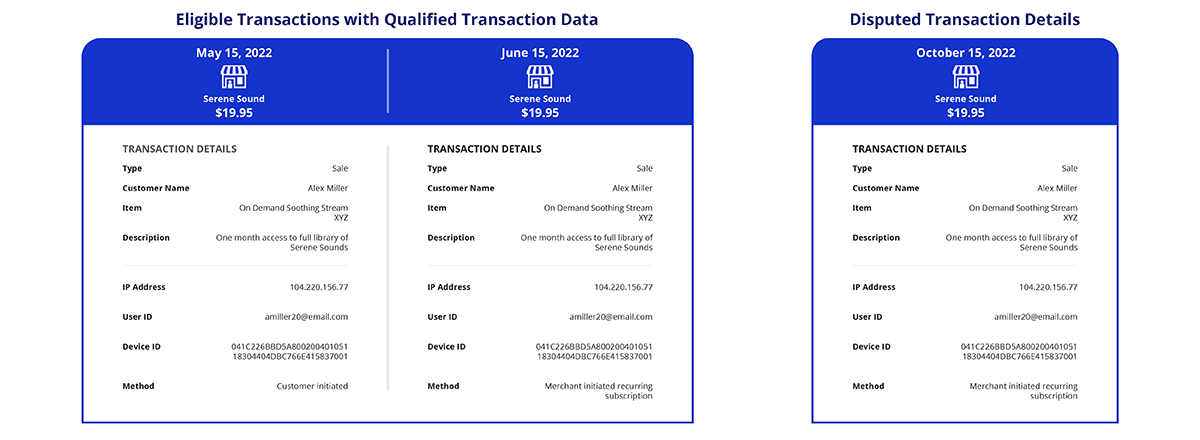

When CE3.0 takes effect, merchants have an opportunity to deflect Visa 10.4 card-not-present fraud by providing Qualified Transaction Data from at least two Eligible Transactions.

What is Qualified Transaction Data?

Criteria or data elements that a seller can share with Visa in a dispute response or pre-dispute scenario to protect themselves against first-party or false fraud. Data elements include:

- IP Address or Device ID/Fingerprint

- One of the following:

- Item Information

- Customer Account/ Login ID

- Delivery Address

Eligible Transactions must meet the below criteria:

- Transactions must be settled between 120 and 365 days prior to the date of the disputed transaction.

- Transactions must not have been previously disputed as fraud.

- Transactions must be made with the same payment method

- The transactions must have the same seller descriptor

If the Qualified Transaction Data for the disputed transaction matches the Eligible Transactions, dispute liability shifts from the seller to the issuer, and the dispute is deflected.

In this instance, a seller’s dispute-to-sales ratio2 and fraud-to-sales ratio for 10.4 fraud disputes are unaffected*.

This shift in compelling evidence rules can be particularly advantageous to subscription merchants who naturally have a built-in transaction history with their cardholders. By providing the issuer with the Qualified Data from at least two prior eligible transactions, miscategorized fraud disputes will be cleared not be reflected on the seller’s account.

Beginning in April 2023, merchants can share the necessary data to avoid illegitimate disputes either prior to the initiation of a dispute, or after a dispute has already been filed. When an inquiry is raised, enhanced data sharing solutions like Verifi’s Order Insight instantaneously relay all the seller’s captured data points directly back to Visa in the pre-dispute phase – deflecting the dispute from ever filing or factoring into the seller’s fraud ratio. Alternatively, merchants can leverage CE3.0 in the post-dispute phase, by manually sharing data as part of a pre-arbitration response; however, if the data sharing occurs post-dispute the dispute will still be factored into the seller’s dispute ratio.

With change on the way, now is the time for merchants to collect transaction data and prepare their business with tools that empower them to leverage the benefits of the 10.4 fraud dispute change.

1Mercator, Chargebacks: Increases in Credit Card Disputes Threaten Merchant Profitability, Nov 2021

2 REPORT: Consumers Admit to Submitting False Fraud to Get Their Money Back, Dec 2021

3 Only applies to qualified seller data shared in the pre-dispute phase through an integration including Verifi Order Insight on transactions that meet specific criteria

* Acquirers may have their own risk assessment parameters, and may levy fees based on such parameters regardless of a seller meeting Visa’s dispute ratio target