PREVENT Disputes

Order Insight® helps your customers recognize transactions and avoid disputes

Combat friendly fraud and defend your business

against unnecessary disputes

Provide issuers and cardholders with detailed purchase information in real time

to validate sales, enrich the customer experience, reduce customer billing

confusion, and deflect first-party misuse, also known as friendly fraud.

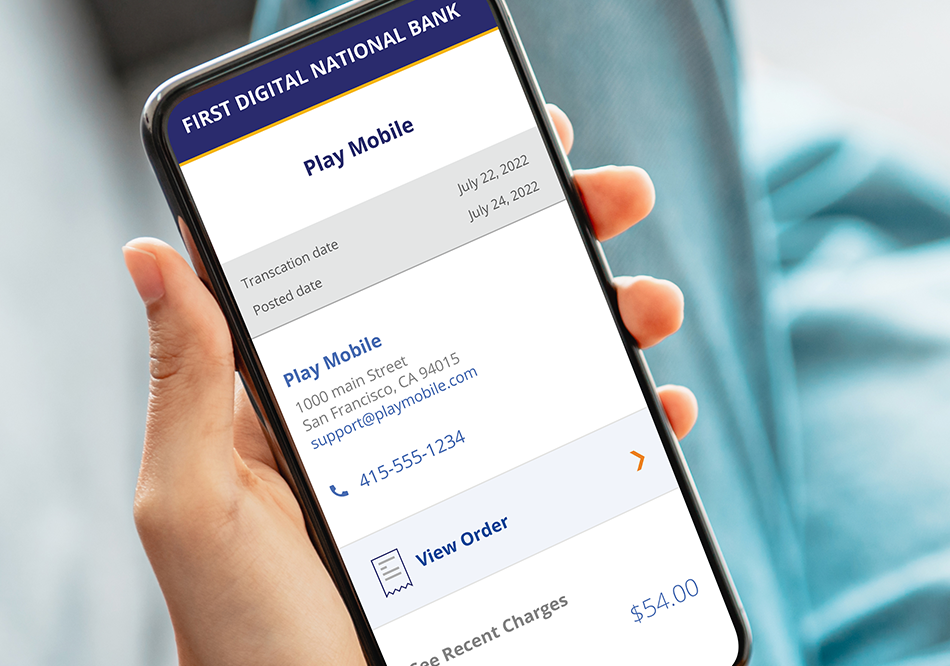

Cardholder Digital Experience

Customers access digital receipts in their online portal or mobile app

Call Center Experience

Call center agents access enhanced transaction detail through back-end banking platform

Fraud Dispute Deflection

Qualified transaction data can validate Visa 10.4 disputes as invalid, blocking future disputes

Prevent Disputes

Make it easy for customers and issuers to review purchase details at transaction inquiry, to combat friendly fraud, preventing unnecessary disputes and fraud claims.

Improve Customer Experience

Empower your customer with simple, on-demand access to order details to self-resolve purchase inquiries with participating issuers.

Enhanced Deflection

For 10.4 reason code disputes, Order Insight provides structured merchant data to Issuers confirming the purchase as legitimate, blocking any future dispute.

Daily Reports

Secure File Transfer Protocol provides flexible reporting formats to suit your business analysis needs including Inquiries, Deflections and Reversals.

Enrich the customer experience

Issuers and cardholders access detailed purchase information from sellers via a global data-sharing network to prevent disputes at first customer inquiry.

Enhance deflection of Visa 10.4 disputes with CE3.0*

Deflect first-party misuse Visa 10.4 disputes with enhanced qualified transaction detail. Order Insight provides qualified merchant data to Issuers to identify and block first-party misuse, reducing fraud and dispute ratios at the pre-dispute stage. Learn more >

Global Network of Issuers

One integration connects you to a global network of over 99% of all Visa issuers and expanding coverage of non-Visa issuer portfolios.

183k

deflections

27+ million

in deflected disputes

45-70%

of eligible disputes deflected

Customer Stories

Learn how businesses benefit from partnering with us.

Order Insight Digital In Action

See how collaboration and data sharing in the dispute ecosystem to allow merchants and issuers to prevent disputes before they become chargebacks

2024 Fraud and Payments Report

Industry research that explores perspectives of consumers, merchants, and issuers on popular payment topics.

Verifi’s RESOLVE solution

Find the pre-dispute opportunity zone! With Verifi’s RESOLVE solution, issuers can achieve quicker resolution and decrease inbound dispute volumes.