Pre-Dispute Solutions

The advent of e-commerce sparked a radical change in consumer purchasing. Distance buying by phone or mail order meant weeks or months of delivery time, but now one-click buying means only an hour or a few days of delivery time. Genius! Savvy e-commerce sellers have come to count on great technologies to better serve their customers. As a result, 4 out of 5 people have found that online purchasing is the way to go.

The downside with the increase of easy, online purchasing? The increase of fraud and disputes. Today’s businesses and financial institutions providing card brand services are deluged with disputes and chargebacks. Since consumers are buying more online, they are also challenging more purchases. Speedy purchasing does have its pitfalls, as some consumers have learned how to game the system by getting refunds from their bank and leaving the seller out of it. This is a typical example of a chargeback. So, where are those equally speedy solutions to protect sellers and card-issuing banks worldwide from the damages caused by disputes?

Visa and Verifi’s Pre-Dispute Solutions

Now, as a Visa company, Verifi is in the ideal position to provide businesses and issuing banks protection against fraud and disputes on a global scale. Protection that equals and anticipates the needs of consumers accustomed to rapid service.

From their foundation, our mutually developed technologies were built with the understanding that today’s businesses and banks need to service their customers quickly and thoroughly. And that means solving a challenged purchase at the pre-dispute stage – before it is submitted as a chargeback by the issuer.

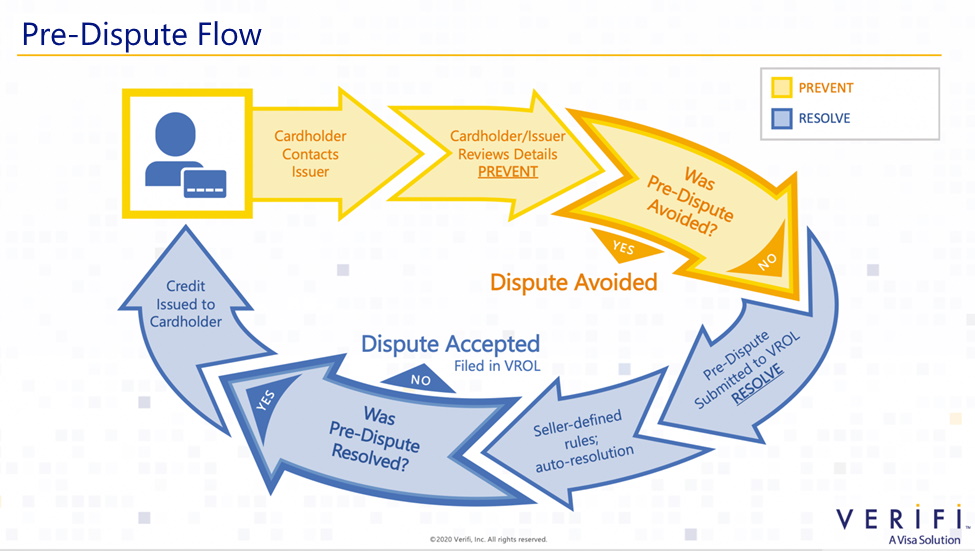

Our pre-dispute solutions go into action at – or even before – the point of customer inquiry with their bank. Issuers and sellers connected to our global platform work in collaboration, sharing seller transaction data and resolution rules to head off disputes at the pre-dispute stage. Instead of weeks or months taken for the chargeback process, draining resources for issuers and sellers alike, now chargebacks can be prevented in as little as a few seconds.

What exactly are pre-dispute solutions? Simple yet advanced technologies that prevent and resolve disputes before they become costly chargebacks. We’ll lay out some simple details below:

PREVENT

Collaboration is the missing piece that solves the puzzle of today’s need for rapid dispute management. Collaboration is the key to our pre-dispute solutions.

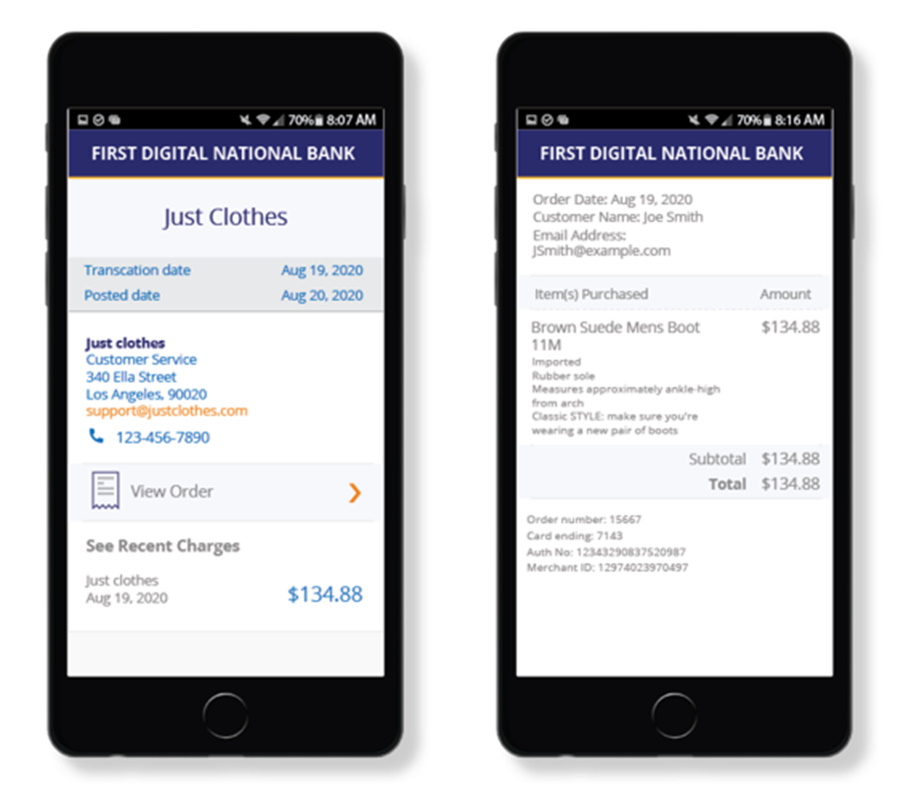

Verifi’s PREVENT enables issuing bank personnel and their customers to view seller transaction details at the moment a purchase is in question. If a customer calls their bank to inquire about a purchase they don’t recognize, then the representative can quickly review the transaction details to confirm a valid sale or prevent an attempt at friendly fraud. A common example of friendly fraud is when the cardholder initiates a dispute with their bank, unaware that a family member made the purchase without telling others in the family.

Issuers can also provide these transaction details to their customers in their online banking portal or mobile app, enabling their customers to self-resolve and prevent an inquiry and dispute. The bottom line: Quick visibility on transaction details can prevent unnecessary disputes.

HOW IT WORKS:

- Sellers direct their transaction data to Verifi’s global network

- Issuers access seller details in real time on Visa Resolve Online (VROL), Visa’s global dispute management platform

- Issuers can review details at the point of customer inquiry, as well as deliver details to online and mobile banking apps for customer self-resolution

Now, sellers and issuers working in collaboration with our data-sharing technology can help solve the $31B chargeback problem by preventing disputes from ever happening – at the pre-dispute stage. Best of all, customers have little or no difficulties and a better post-transaction experience. But what about disputes that can’t be prevented by this process?

RESOLVE

Sometimes, true fraud happens. Sometimes, customers receive delivery of defective products or services – or NO delivery at all. Maybe a cancelled subscription service didn’t get properly cancelled. Or the dispute simply isn’t worth a seller’s time and resources to battle. There are many scenarios for unpreventable disputes.

Verifi’s RESOLVE provides the solution for issuers and sellers to resolve disputes at the pre-dispute stage, stopping a chargeback from ever happening. Our automated service, Rapid Dispute Resolution (RDR), gives sellers the power to define rules for immediate resolution when a Visa dispute is submitted in VROL. For disputes submitted on all other major card brands, sellers can respond to dispute notifications delivered by participating issuers within 72 hours to choose to resolve a dispute and stop the chargeback process. As with PREVENT, inquiries and submissions prevented or resolved at the pre-dispute stage do not count against a seller’s dispute ratio.

Preventing or resolving purchase problems at the pre-dispute stage can help sellers and issuers provide a better customer experience. Today’s customers expect more, and they expect it to happen as quickly as possible. Verifi pre-dispute solutions serve those needs when it comes to disputes.

Here’s how the simple process works:

What Pre-Dispute Solutions Mean for the Payments Ecosystem

Real-time payments need real-time solutions for fraud and dispute problems. PREVENT and RESOLVE provide the payments industry with the ability to provide the service customers expect and deserve, as well as ensure that resources and revenue streams are protected from strain caused by disputes and chargebacks.

- Prevent and resolve disputes at the pre-dispute stage

- Keep dispute ratio low and avoid high-risk programs

- Reduce the workload on operations

- Provide an improved overall customer experience

Working Together in Dispute Management

Visa and Verifi are committed to making our collaboration solutions available to sellers and issuers around the world. Seller-issuer collaboration enables all stakeholders in payments to help solve the growing problem of disputes as an inside job. The result is a more robust and healthier payments ecosystem.

Finally, it’s the consumers who may benefit the most. Customers deserve to feel protected when they buy online. Now, sellers and issuers can feel more protected as well.

To learn more about how Verifi’s Pre-Dispute Solutions can protect your business and better serve your customers, contact us today.

50 Retail Stats To Consider For Your Brand’s Future – Forbes