Rapid Dispute Resolution

The rapid growth of e-commerce in recent years has brought about great demand for technological advancement to accept and process digital payments. As online transaction volume grows, there has been an evident rise in disputes, leading to the need for new technology to prevent and manage fraud and disputes. The first half of 2020 has seen some extraordinary changes in online sales and services, including disturbing reports on the increase of disputes. For starters, in May 2020, global e-commerce sales grew 81% over May sales of the previous year. At the same time, non-fraud chargebacks increased 25% overall. Disputes are on the rise, and current mitigation solutions may not be sufficient. The payments industry needs new technology to manage the volume. Fortunately, Visa and Verifi have developed the latest solution for sellers and issuers alike – Rapid Dispute Resolution (RDR).

RDR was designed to deliver dispute resolution in real time, driven by an automated decision engine. Sellers can customize rules to auto-resolve disputes at the point of first customer inquiry, to stop disputes from escalating to chargebacks. As a result, seller accounts are protected from increased chargeback ratios, more issuer-submitted disputes are resolved to reduce chargeback volume, and the customer experience improves overall. RDR eliminates the manual work typically involved in reviewing and resolving routine disputes, relieving undue demand on seller operations. Rapid Dispute Resolution is the essential tool for this age of high-volume e-commerce.

The E-commerce Explosion

Now, there is no shortage of ways to make purchases. The unprecedented sophistication of online payments has branched into increased channels of purchasing opportunities for businesses and consumers, often referred to as omnichannel purchasing. These advances, such as Internet of Things (IoT) and digital wallets, have benefited many but have also allowed new vulnerabilities for fraud and dispute manipulation. Innovation in fraud and dispute prevention technology must exceed the concept of anticipation and scalability and address these challenges at the root, when customers present inquiries and disputes to their issuers. RDR is one such technology.

Fraud Reporting and Chargeback Protection

To understand the necessity of implementing real-time dispute resolution, it is important to briefly review dispute management in the age of e-commerce. In an effort to improve fraud prevention, sellers have solely depended on accessing TC40 data claims files and reconcile that data with their customer history and transaction data. Use of this information can be effective in preventing future fraud or even informing sellers that a dispute had been filed, but it provides no proactive guarantee to prevent disputes and chargebacks in real-time. Although this continues as a sensible practice to reduce future fraud and disputes, it has little effect in current frictionless payment channels that are too often vulnerable to real-time fraud and dispute challenges.

The data in these files is submitted by issuers after a fraud claim, then distributed to the payment card networks and compiled in the Risk Identification Service (RIS) report for Visa and the System to Avoid Fraud Effectively (SAFE) report for Mastercard. Once compiled, they are made available to acquirers and sellers. These reports comprise a tremendous amount of data, which can require a lengthy manual review by sellers before acting on the information. In short, quick solutions for fraud and dispute management are not an option with this method.

Real-time disputes and chargebacks still threaten sellers with the compounded loss of revenue, diminished customer loyalty, and damaged brand equity. Sellers need a more agile way to react to disputes in real time.

Direct Fraud & Dispute Notifications

The next development in fraud and dispute management came in the form of early notification solutions for sellers. Sellers needed technology to deliver more accurate fraud and dispute data faster to prevent disputes from being submitted for processing into chargebacks. Resolving disputes prior to entering an issuer’s dispute process could prevent fraud filings and provide customers a better experience overall.

Enter Verifi’s Cardholder Dispute Resolution Network™ (CDRN®) – the first direct-to-issuer integrated solution providing sellers the opportunity of dispute resolution prior to an issuer’s inescapable chargeback process. Now, sellers could act quickly on near real-time dispute notifications to prevent the compounded losses from the risk of unresolved disputes and chargebacks.

Automated Dispute Resolution – RDR

We have now entered a new era in payments and dispute management. Collaboration and data-sharing among sellers, acquirers, and issuers have become a necessity in the effort to preserve customer relationships and reduce the wide-ranging damage caused by fraud and disputes. RDR’s automated dispute decisioning is the first of its kind in the payments industry.

Enabling real-time dispute resolution significantly benefits all players in the payment ecosystem.

- Sellers: Hands-off dispute resolution, no manual review, no impact on dispute ratio, automation accommodates new and evolving business models

- Preserve brand reputation

- Deliver better customer experience through quicker resolution at point of inquiry

- Acquirers: Provide differentiation in seller services

- Retain and grow existing client base

- Increase value with platform services

- Issuers: Reduce dispute processing volume and provide an overall better cardholder experience

- Reduce demand on operations and costs for disputes

- Easily meet governmental and industry regulation requirements

- Reduce write-offs and other liabilities

How RDR Works

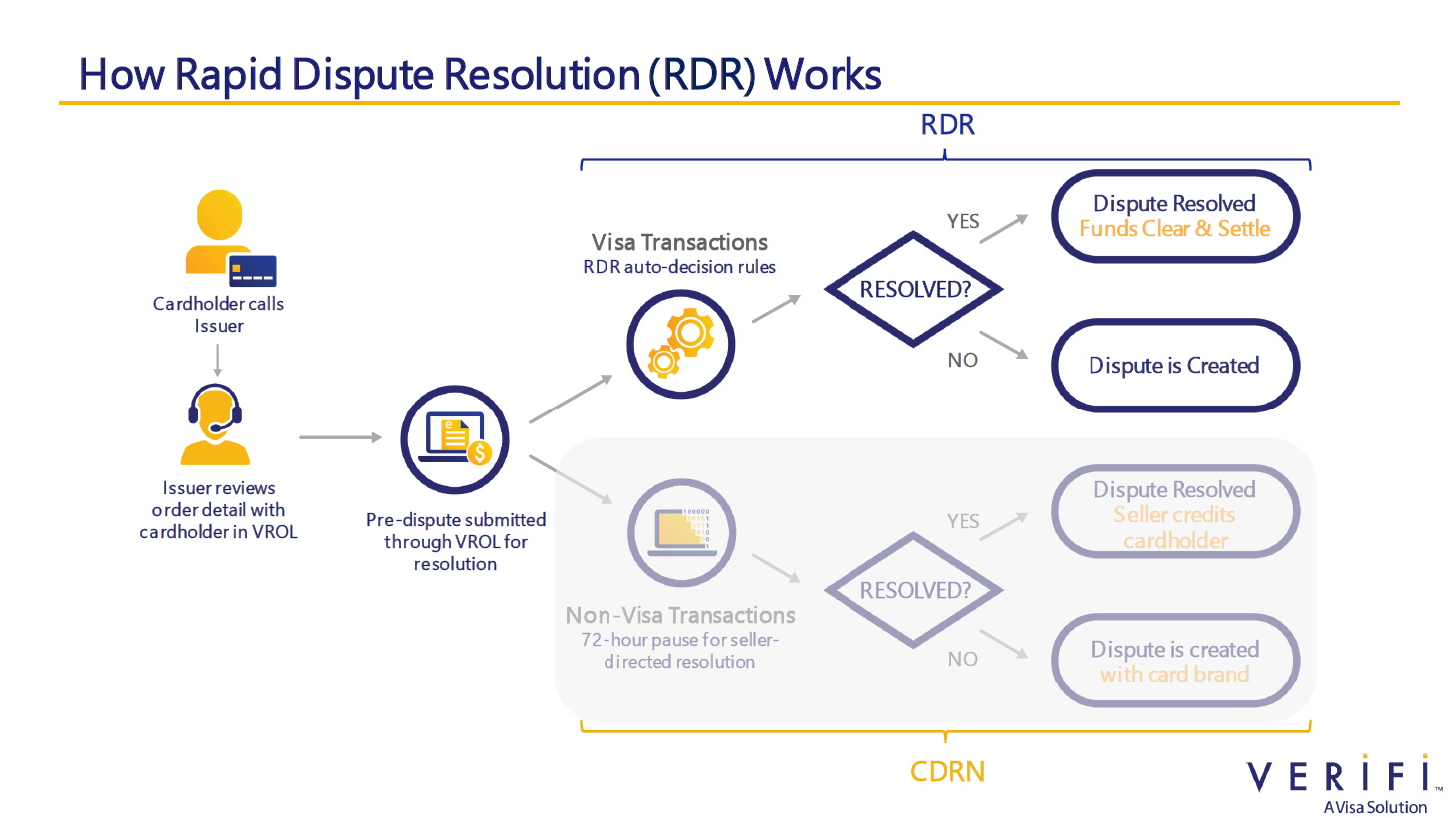

RDR is enabled in Visa issuers’ dispute management platform, Visa Resolve Online (VROL). Once a transaction dispute is submitted into VROL, it is automatically reviewed by the RDR decision engine embedded in the Verifi platform, and a decision is made to resolve based on pre-set, seller-defined rules and attributes. Qualifying disputes are automatically resolved and funds are moved from the seller’s acquirer to the issuer.

Example scenario of RDR in action: A seller has determined that fraud disputes under a certain value, e.g. $20, should be typically refunded. The seller will simply define one rule for both fraud disputes in Visa dispute category 10.X – fraud and disputes equal to or less than $20. When a dispute is submitted that is categorized as fraud and is valued at $20 or less, RDR will immediately trigger a resolution, and Visa will notify the acquirer on existing rails to automatically move funds to the issuer for that transaction.

In real time, all parties along the payment chain are made aware of the resolution, and the process of moving funds from acquirer to issuer is initiated. From this point on, the process requires no manual review or any kind of action on the seller’s part.

The RDR Difference

As the first of its kind, RDR will provide the payments industry with the ability to automatically resolve select transaction disputes in real time – seamlessly and without any additional operational demands. The built-in scalability will ensure that RDR best serves specific business needs, resolving fraud and non-fraud disputes, protecting brand equity, and improving customer services for sellers, acquirers, and issuers on a global scale in the e-commerce age.

To learn more about how RDR can protect your business, contact us today.