Total Dispute Management and Pre-Disputes

In October 2019, Visa acquired Verifi. Since day one, the companies have been exploring ways to prevent or resolve disputes quickly. Since then, we have made tremendous strides integrating our solutions with Visa’s infrastructure and have co-developed a revolutionary product, Rapid Dispute Resolution (RDR) – the first fully automated dispute management solution. This is significant because much of the cost of disputes is in the operational time it takes to manually process and resolve a dispute or represent a chargeback.

Verifi initially leveraged opportunities with our original Chargeback Representment service and Cardholder Dispute Resolution Network™ (CDRN®). But when we combine our pre-dispute solutions, PREVENT and RESOLVE, with Visa’s risk and fraud management solutions, we create something greater. Our combined technologies foster brand-agnostic collaboration among all stakeholders, delivering dispute management solutions that are intelligent, data-driven, and customer-centric.

Visa has expertise in acquirer and issuer solutions, global payments coverage, and has made significant inroads with the deployment of the Visa Merchant Purchase Inquiry (VMPI), which has been renamed as Verifi’s Order Insight® (PREVENT).

Verifi has strong relationships with sellers and issuers, payments protection coverage in North America and Europe, and had already gained ground with dispute solutions CDRN and Order Insight.

Marrying these strengths, together we are reinventing the dispute space with a full suite of Total Dispute Management solutions, providing data transparency, automation, efficiency, and recovery of funds otherwise lost to disputes (chargebacks).

Introducing Pre-Dispute Management

Above is the conventional chargeback flow, from cardholder inquiry to representment from the seller. Our goal is to stop chargebacks at the pre-dispute stage, redefining the system.

Our focus going forward is to introduce, expand, and innovate pre-dispute management. Preventing or resolving disputes before they’re submitted to card brands as a traditional chargeback will save time, expenses, and protect the seller’s dispute ratio.

In the usual chargeback flow, after the dispute is submitted to Visa Resolve Online (VROL), a lengthy process begins by sending the dispute to the seller through the acquirer. This puts operational and financial burdens on all stakeholders involved, with constant communication between seller, acquirer, and issuing entities – all in a very compressed timeframe. Sellers must create compelling evidence cases. Acquirer teams must process paperwork for sellers to fight the dispute. All this work mounts up just to provide issuers with more information about a transaction. Then issuers must staff back-office teams to intake and review this compelling evidence and decide the outcome of the dispute. It’s quite apparent that simple, clear communication has been lacking in this process for some time.

With their improvements to the standard dispute process, Visa was able to successfully reduce the average time frame for dispute resolution from 55 days to 24 days. Since joining forces with Visa, Verifi has developed Rapid Dispute Resolution to resolve a pre-dispute even faster – in one second.

Visa & Verifi – Better Together

By combining Visa and Verifi’s expertise, we are rapidly innovating the dispute space, creating dispute management solutions that empower greater levels of transparency, efficiency, automation, cost savings, and revenue retention for partners worldwide.

PREVENT Is Proactive

The PREVENT solution is powered by Order Insight and enables sellers to share data with issuers in real time, while the cardholder is on the phone with an inquiry. For issuers, it reduces call center time, provides greater transparency for their cardholders, and delivers stickier solutions on all the main cardholder touch points.

RESOLVE Is Reactive

When a cardholder wants to initiate a dispute, RESOLVE provides sellers the opportunity to return funds to the cardholder to avoid escalation. This solution can lessen the impact of a negative customer experience with the seller’s brand, reduce seller dispute ratios, and keep countless disputes out of the payments ecosystem. Issuers can also reduce the time to close a case from weeks to seconds, while providing world-class customer service and reducing operational costs.

INFORM For Educated Decisions

INFORM provides sellers with near real-time data from all global Visa issuers to update their systems and fraud models and protect against future losses, while evolving the customer experience.

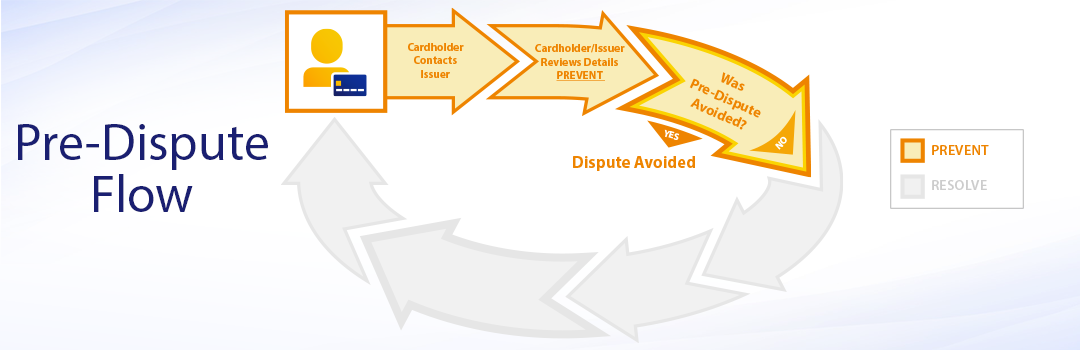

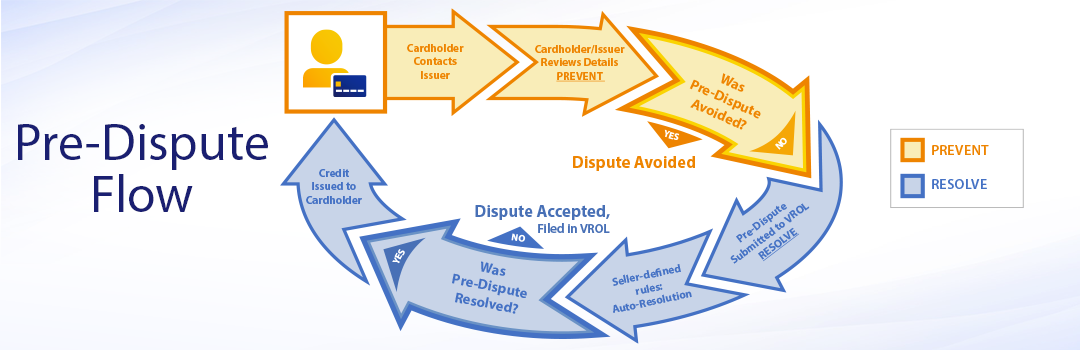

Pre-Dispute Flow – PREVENT

Now that we have identified what a pre-dispute is and what solutions Verifi and Visa provide to help the ecosystem – how do they interact?

When a cardholder has a transaction inquiry, they most often reach out to their bank instead of the seller. This is where the Total Dispute Management Suite comes into play.

PREVENT provides the means for sellers to send issuers enhanced transaction details or a digital receipt. This is detailed information that an issuer call center can review with the cardholder at that point of initial inquiry. This data presents compelling evidence to cardholders and can prevent loss due to forgetfulness or buyer’s remorse and can help identify intentional fraud.

Issuers can also deploy this same data into their mobile or digital banking applications to enable cardholders to self-validate sales. This cardholder access can lower operational strain on issuer call centers, and it enhances the customer experience for both seller and issuer.

However, if the pre-dispute cannot be prevented at the initial cardholder inquiry, then the issuer can then attempt to resolve the pre-dispute.

Pre-Dispute Flow – RESOLVE

RESOLVE facilitates a quick-and-easy automated resolution through a decision engine operating on rules set by the seller. For example, sellers can set a rule to refund pre-disputes under $10, or for a certain descriptor, for a certain reason code, or even a specific issuer. If the transaction details meet the rules set by the seller, then Visa’s network will resolve the inquiry. Funds are returned to the cardholder, an immediate and final resolution is made, and an improved cardholder experience is attained on behalf of the seller and issuer.

Pre-Dispute Management – The Sooner the Better

By adopting the PREVENT and RESOLVE pre-dispute solutions, sellers can experience immediate and lasting positive effects on their business. Seller accounts are protected against friendly fraud, buyer’s remorse, and lost merchandise. Additionally, both issuers and sellers protect revenue channels from reduced operating costs.

Pre-dispute solutions empower sellers, acquirers, and issuers to share data for quick and easy prevention and resolution at the point of customer inquiry. And an automated process means resources are freed up, enabling payments stakeholders to focus on business growth and innovation.

The Next Evolution

It’s evident, as the events of 2020 have proven, that nobody can predict the future. But one thing we are confident of is innovation and collaboration in our business is key to making the dispute and pre-dispute processes better for all involved.

Payments continue to change and are evolving faster all the time. Consumer behavior is also changing, as more consumers are shopping online and paying with digital wallets.

Disputes remain a key component of payments, and successful management of them requires trust and transparency when things go wrong. So, continuing to evolve the dispute process is vital – and Visa and Verifi are committed to doing just that.

If you missed Part 1 of this series, you can find it here.

1 Visa Claims Resolution Updates, 2018

2 Average resolution rate (hours) for CDRN (Jan – Dec 2019)

3 Average response time based on Beta testing data, July/Aug 2020

4 Visa Internal Reporting