In 2020, Verifi and Visa launched Rapid Dispute Resolution (RDR), our most innovative dispute resolution product to date, an integral part of our RESOLVE solution. Since then, we’ve continued to expand issuer adoption of RDR achieving global availability, coverage, and protection with the most effective real-time resolution service in the payments ecosystem.

This article will explain how RDR extends dispute resolution coverage including recommended best practices for reconciliation.

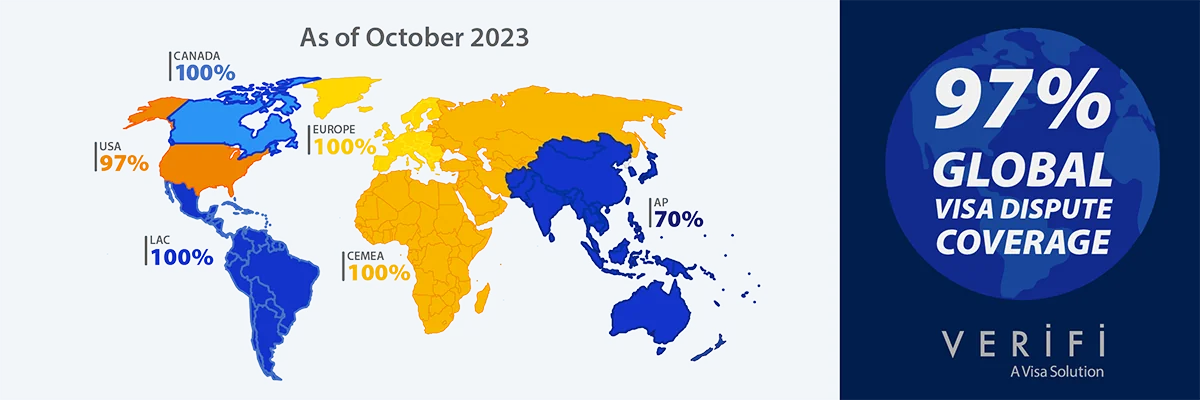

At present, RDR pre-dispute resolution services are available in over 40 countries by thousands of issuers at 97% global Visa issuer coverage.

Visa RDR Enhancements and Expansion – Timeline

October 2022

As of October 15, 2022, all issuers in the Latin America-Caribbean (LAC) region will be activated for RDR. The LAC region is the second largest on the Visa network, as measured by dispute volumes.

April 2022

In April 2022, coverage in the Europe region reached 100% with the activation of remaining EU issuers for RDR.

January 2022

In January 2022, all Visa issuers with disputes in the Canada region were activated. Coupled with this global expansion was the addition of the largest debit issuer portfolio in the United States.

October 2021

Auto enrollment of Visa issuers in RDR was announced in Visa’s April 2021 Business Enhancements Release (BER). To further expand global coverage of RDR, Visa’s October 2021 BER mandates issuer participation in the United States, Europe, Central Europe-Middle East-Africa, and Asia-Pacific regions.

April 2021

As of April 2021, acquirers were mandated to upgrade their systems to clearly reflect RDR cases, improving RDR visibility and reconciliation for sellers. Verifi and Visa are actively engaged and continue to work with acquirers still in process of updating RDR transparency within their systems.

Visa announced an update to their acquirer fee structure for disputes, effective October 2021, designed to incentivize acquirers to support RDR for technical readiness and eliminate dispute fees on RDR resolved transactions.

What Is the Value of Pre-Dispute Resolution and RDR Automation?

RDR operates at the pre-dispute stage, meaning the resolution occurs before a dispute case is submitted into the standard chargeback management process. Not only does the introduction of RDR at the beginning of the customer dispute journey remove the burden of downstream dispute management and related costs for sellers, but it also reduces the overall volume of disputes that impede efficiency of operations for all stakeholders in the payments ecosystem.

As a fully automated dispute resolution service, RDR provides sellers with exceptional ease of use that is supported by Visa’s global network of issuers. To start using RDR, all sellers need to do is determine the rules and attributes which will determine the acceptance or refusal of a pre-dispute case. Simply put, sellers must create the parameters that define whether to refund. By selecting the rules and defining attributes that best serve the individual needs for their business, sellers can simply “set it and forget it” – automation does the rest. When an RDR enrolled issuer enters a pre-dispute into VROL, Verifi’s decisioning engine automatically triggers resolution set by the seller’s rules. No seller review or action is required to resolve the case. Disputes are resolved in sub-second time at the pre-dispute stage, ensuring no chargeback will ever occur. This also ensures the seller’s dispute ratio is not affected.

To make it as simple as possible for our seller clients, all RDR case information is delivered through the same web portal that Verifi clients know and love, MyCDRN. RDR case resolution data can also be delivered daily via Secure File Transfer Protocol (SFTP) for simple reconciliation.

Best Practices for RDR Case Reconciliation

As outlined in the Visa mandatory technical enhancements for acquirers, as of April 2021, acquirers are required to differentiate RDR-resolved pre-dispute cases as separate from traditional chargebacks in their systems. Verifi and Visa are working with acquirers to validate that the technical changes have been made. Sellers may need to work with their acquirer contacts to determine how RDR cases are differentiated in their systems, UIs, reports, and invoices.

If an acquirer has not yet made the technical changes required by Visa, then RDR cases may appear as chargebacks in the acquirer’s systems. Sellers can use order information such as transaction date, transaction amount, card details, or ARN (acquirer reference number) if provided to reconcile RDR details with their acquirer reporting.

*Coverage is subject to change as Visa works to engage on RDR adoption directly with issuers in parallel with the mandate to drive coverage and participation of RDR across all regions globally.