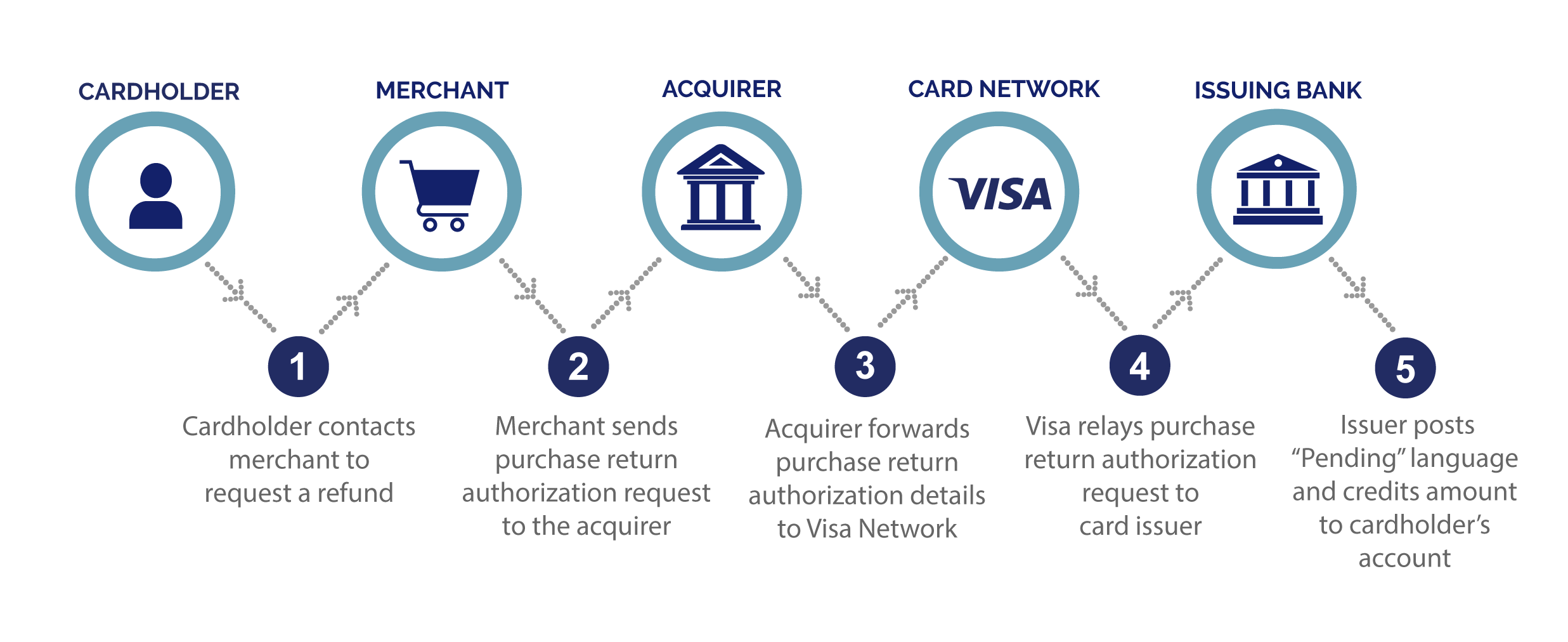

Effective October 19, 2019, Visa will require merchants in the US, Canada, and LAC to perform a purchase return authorization on each cardholder refund. In turn, issuers are required to make these pending return authorizations visible to consumers via online banking and mobile applications, driving transparency to consumers when a refund is in process.

Effective October 19, 2019, Visa will require merchants in the US, Canada, and LAC to perform a purchase return authorization on each cardholder refund. In turn, issuers are required to make these pending return authorizations visible to consumers via online banking and mobile applications, driving transparency to consumers when a refund is in process.

Purchase Return Authorization will enable consumers to view their pending refund in near real-time, reducing inquiries to merchants and issuers and minimizing premature disputes. This is a win for all parties!

Prior to this mandate, the widely adopted process for purchase returns was for a merchant to submit their refunds directly for settlement in a daily batch file. Returns/refunds could take several days to complete, slowly moving in process as they move from the merchant to their acquirer and to the issuing bank, taking days for the consumer to receive their funds. By authorizing a purchase return prior to settlement, issuers provide consumers with almost immediate visibility to a pending refund, so they know their return request is in process and their funds are on the way.

Issuer Requirements

The following dates apply to Visa issuers:

| Effective Dates | Regions | Requirements |

| April 14, 2018 | USA, Canada, LAC, CEMEA, AP | Prepared to receive and respond to authorizations on credit vouchers/purchase returns |

| April 18, 2020 | Europe | |

| October 13, 2018 | USA, Canada | Process credit transaction so cardholder applications are updated with pending credit information in same time frame as a purchase transaction |

| April 12, 2019 | LAC | |

| October 19, 2019 | AP, CEMEA | |

| April 18, 2020 | Europe |

By April 2020, Visa will expand its Visa Claims Resolution (VCR) initiative to contain a new dispute right for issuers where a dispute can be filed if a return transaction is processed without proper authorization, via reason code 11.3. This new dispute right will serve as a means of enforcement to ensure all parties are collaborating on returns.

What to Do When a Purchase Return Authorization is Declined

Why would a return authorization be declined? Sounds counterintuitive, when the merchant is trying to return funds to their customer, right? However, this scenario could occur for a number of reasons:

- Card account has been closed

- Pre-paid card was used and discarded

- Issuer’s return authorization parameters are too strict

These are edge cases; however, with remediation plans and processes in place in advance, you should be well-equipped to handle these types of situations should they arise.

Common Scenarios and Issuer Best Practices to Remedy Declined Return Authorizations:

Scenario 1: Merchant attempts to return funds to the cardholder, but the card account is closed.

Solution: Approve the return request and direct funds to the cardholder’s new account, if available. If unable to identify a new account, it’s considered best practice to decline the return authorization and direct the merchant to seek an alternative payment method.

Note: it’s important to ensure dispute staff is prepared to accept proof of refund to an alternate card as sufficient evidence for merchant representment.

Scenario 2: Original purchase was made on a pre-paid card and the card was discarded after use – but cardholder initiated a return.

Solution: Decline the authorization and direct the merchant to refund an alternative payment method.

Scenario 3: Strict issuer return authorization rules/fraud filters are preventing approval on eligible cards

Solution: Review your internal or third-party processing solution’s authorization rules and scoring to ensure all eligible refunds are successfully authorized.

Visa is launching its Purchase Return Authorization mandate as another collaboration initiative to better-inform consumers, merchants, and issuers. Direct visibility to pending returns improves consumer awareness, reducing inquiries and disputes. Purchase return authorization declines may occur, so it’s important to provide clear decline responses to equip merchants with the visibility to promptly resolve the consumer request and avoid unnecessary disputes.

Verifi has been a leading expert in the payment space since the launch of our first collaboration solution, Cardholder Dispute Resolution Network™ (CDRN®) in 2007. Please reach out to your relationship manager if you need any assistance preparing for the upcoming mandate.