Resolve disputes before chargebacks occur

Resolve disputes with automated decisioning technology that intercepts disputes before a chargeback initiates to help merchants take control of their dispute-to-sales ratios.

What are chargebacks costing your business?

Quick and easy dispute resolution

Our unified dispute resolution tool eliminates both Visa and non-Visa chargebacks by proactively initiating a cardholder credit to transaction disputes before a chargeback is triggered.

Delayed decisioning

Cardholder Dispute Resolution Network (CDRN)

Drive call center operational costs down with merchant-initiated decisioning. Merchants have 72 hours to initiate a cardholder credit to resolve Visa and non-Visa transaction disputes before a chargeback is filed.

Auto-decisioning

Rapid Dispute Resolution (RDR)

Optimize your dispute prevention strategy with auto decision technology to eliminate disputes with low recovery rates. Merchants can automatically resolve Visa disputes with a customizable decision engine that instantly credits the cardholder before a chargeback is initiated.

Eliminate over-refunding

Guarantee transactions will not resurface as chargebacks. Disputes resolved with CDRN or RDR are not eligible for future disputes.

Reduce operational costs

Optimize your process to reduce disputes with low recovery rates. Avoid costly fees, fines, penalties and potential loss of processing privileges.

Improve dispute ratios*

Enhanced control over dispute volumes gives merchants immediate control over their dispute ratios. Disputes resolved before a chargeback initiates do not count against Visa’s dispute ratio.

Leverage Global Reach

Scalable solutions give merchants the freedom to grow all over the world. Access a network of global issuers across Visa and non-Visa card networks (Mastercard, Discover and American Express).

* Acquirers may have their own risk assessment parameters, and may levy fees based on such parameters regardless of a seller meeting Visa’s dispute ratio target

Auto decisioning is now even more powerful and flexible

With the RDR Decision API, merchants implement their own custom logic to determine which RDR cases to accept. Merchants can create rules specific to their business needs, industry, or payment type.

Merchant-hosted decisioning provides expanded flexibility for decision criteria

Customize RDR to fit your business’s dispute, chargeback, and customer engagement strategy

Merchants have full control over decision criteria and can self-serve for rule creation and reporting needs

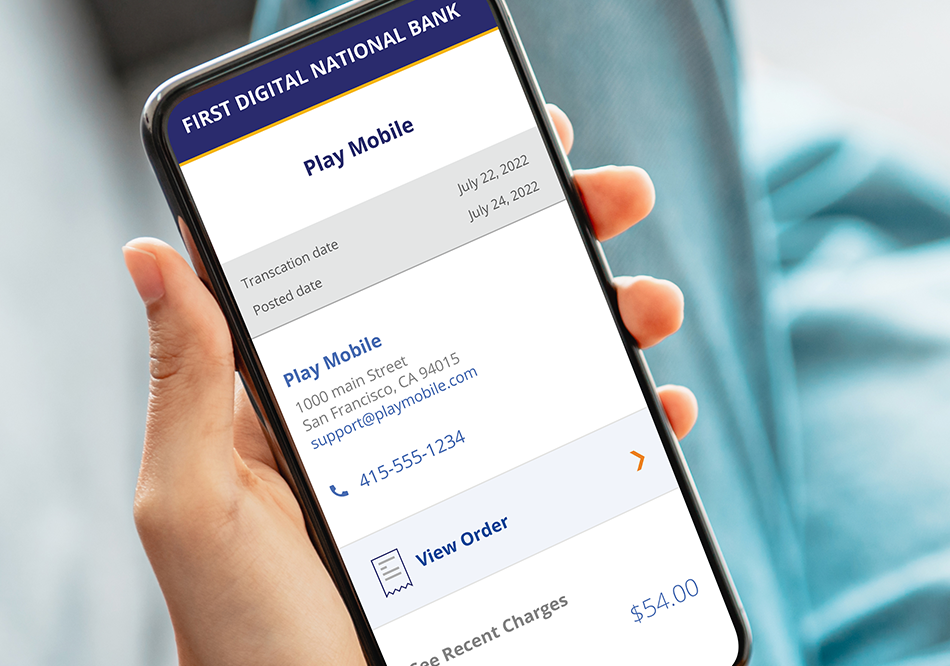

See how CDRN and RDR work

Not all disputes are worth the cost it takes to fight. See how delayed decision and auto decisioning work to easily resolve disputes to stop chargebacks from ever occurring.

What are chargebacks costing your business?

It costs more than the value of the transaction to fight chargebacks. Enter your numbers to see the true cost of chargebacks accounting for added operational costs, fees, and penalties.

Learn more

Learn how businesses benefit from partnering with us.

Case Study

See how Order Insight helped others fight chargeback fraud and measurably reduce fraud & dispute ratios.

2025 Payments and Fraud Report

Industry research that explores the perspectives of consumers, merchants, and issuers on popular payment topics.

A holistic dispute management strategy

See how the dispute opportunity zone works to create a holistic dispute management strategy.