Prevent chargeback fraud with data transparency

Order Insight® helps merchants stop friendly fraud with automatic data transmission that prevents inquiries from triggering chargebacks.

Dispute management starting with prevention

Order Insight harnesses the power of data to promote transaction transparency to all stakeholders: cardholders, merchants, and issuers. Data sharing occurs at three touchpoints to stop first-party-misuse disputes before a chargeback is triggered.

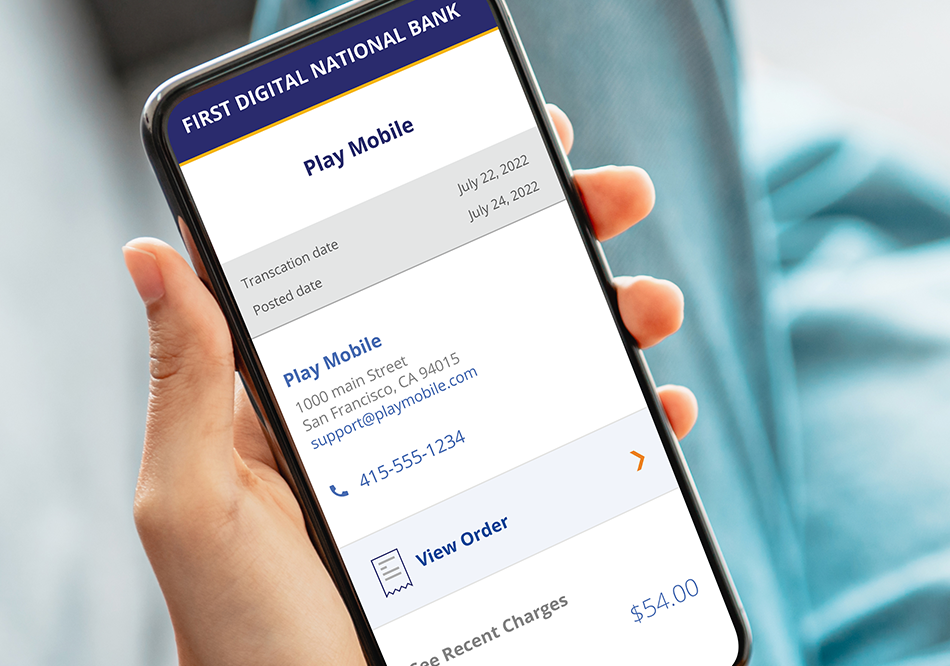

Improve cardholder experience

Order Insight’s digital experience bridges the communication gap between cardholders and merchants by providing full purchase information with a complete digital receipt within the cardholder’s own mobile banking application or online portal.

Empower issuer call center

Order Insight gives call centers access to enhanced transaction detail through a back-end banking platform that empowers customer service agents to have a fuller picture of the transaction.

Automatic dispute deflection

Order Insight’s Systematic Dispute Deflection feature leverages the Visa Compelling Evidence 3.0 rule to deflect disputes before a chargeback is issued. Automatic data sharing with the issuer effectively blocks confirmed first-party-misuse on Visa card-not-present fraud disputes.

What are chargebacks costing your business?

It costs more than the value of the transaction to fight chargebacks. Enter your numbers to see the true cost of chargebacks accounting for added operational costs, fees, and penalties.

Learn more

Learn how businesses benefit from partnering with us.

Case Study

See how Order Insight helped others fight chargeback fraud and measurably reduce fraud & dispute ratios.

2025 Payments and Fraud Report

Industry research that explores the perspectives of consumers, merchants, and issuers on popular payment topics.

Verifi+ session: Level up your dispute operations

Disputes play an integral role in the post-purchase experience, watch our webinar to learn how you can improve your dispute operations with Verifi.