Blog | Industry Insights

-

Limitless Chargeback Resolution Decisioning Capabilities

With a rising volume of online transactions and corresponding chargebacks, merchants are increasingly challenged with chargeback problems as unique as each business. Finding the right dispute mitigation strategy is intensely personal to each merchant and it can be difficult to strike precisely the right balance for a cost-effective strategy. Starting in March 2025, Verifi will…

-

The Power of CDRN and RDR

Visa post-purchase transaction dispute volumes went up more than 7% in 2023 alone1. The combination of lost sales, dispute fees, operational costs, relating to disputes, can cause merchants to lose unnecessary revenue. An active chargeback prevention strategy can help merchants limit post-purchase losses by stopping disputes in the interim between when a cardholder initiates a…

-

Is your business a good candidate for CE3.0 deflection?

Launched in April 2023, Visa’s Compelling Evidence 3.0 (CE3.0) represents a major shift in chargeback fraud protection for merchants; but some merchants are more equipped than others to reap the benefits. Is your business well positioned to harness the benefit of the rule change for a proactive chargeback mitigation strategy that fights chargebacks in the…

-

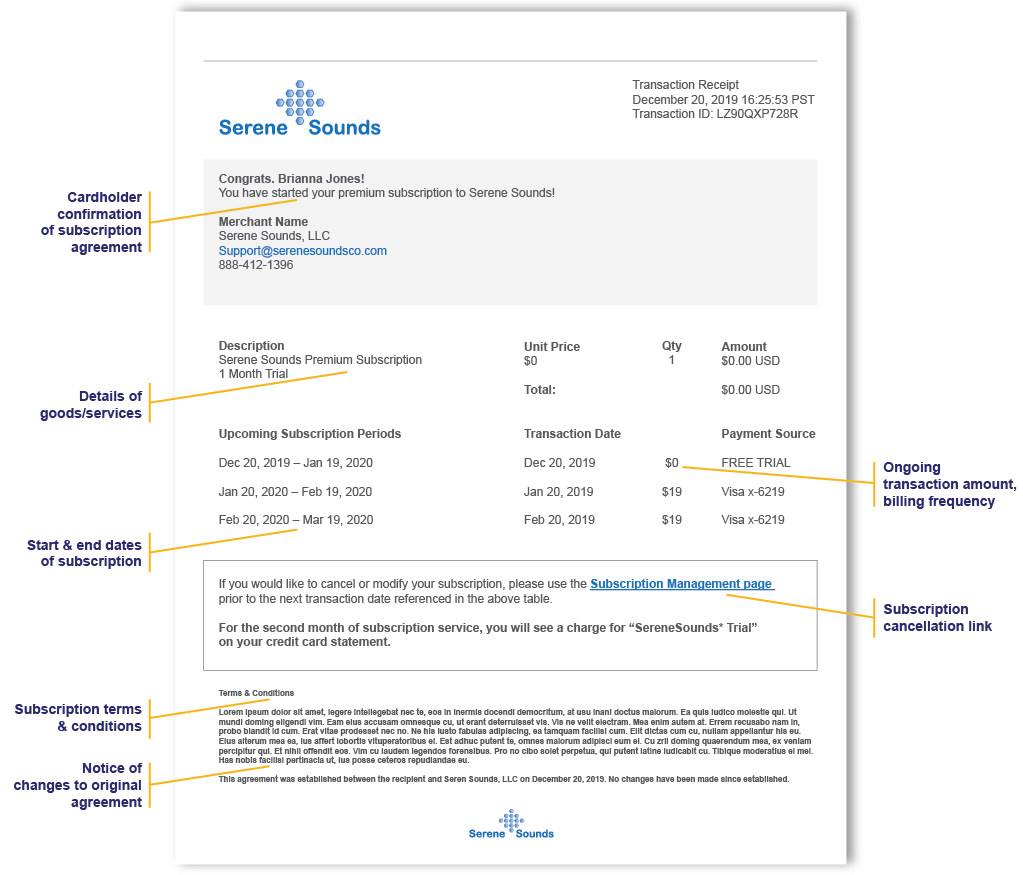

Jogging a Customer’s Memory to Prevent Friendly Fraud

The very thing that makes subscription services so valuable is also the driving force behind subscription-related card disputes. Recurring transactions are inherently structured to provide ease so consumers don’t have to remember to make payments. But when service is so streamlined, consumers can either forget what the charge is for when looking at their billing…

-

Compelling Evidence 3.0 301 Training: Qualified Transaction Matching

Visa’s new compelling evidence 3.0 (CE3.0) takes effect this April 15th, 2023. Here’s what you need to know. What is CE3.0? Visa’s latest evolution of compelling evidence requirements for 10.4 fraud disputes, designed to help reduce first-party misuse (friendly fraud) in the post-purchase ecosystem. How to Use Verifi’s Order Insight with CE3.0 In the months…

-

ICYMI: Removing Disputes Has Risen to the #1 Concern for Merchants

According to a recent survey, removing transaction disputes from the payments ecosystem has become the number one concern for merchants, with a tertiary concern of fraudulent chargebacks, otherwise known as first-party-misuse1. The question is – how do you stop payment disputes and still do right by your customer? Research shows it’s five to twenty five…

-

Visa Compelling Evidence 3.0

For Subscription Merchants Starting in April 2023, the introduction of Visa’s new Compelling Evidence 3.0 (CE3.0) may give relief for subscription merchants who have struggled with first-party misuse (friendly fraud) for years. The ease and convenience of reoccurring subscriptions is ideal for customers; but the billing model can put merchants at greater risk for chargeback fraud,…

-

Compelling Evidence 3.0 (CE3.0) in the Pre-dispute and Pre-arbitration Environments

Merchants, especially those operating in a card-not-present environment, have seen increased instances of fraud over the last few years. Between 2019 and 2021, annual Visa CNP sales grew 51% and chargebacks grew nearly 30% globally1. Many of these are false credit card disputes inaccurately categorized as fraudulent and may actually be the result of friendly…

-

“Friendly Fraud” is on the rise. Visa’s new Compelling Evidence 3.0 aims to help merchants level the playing field.

According to Visa internal reporting, friendly fraud can account for up to 75% of all chargebacks. “Friendly fraud is not always friendly, especially from a merchant’s perspective,” said Mike Lemberger, Senior Vice President of North America Risk at Visa. The Fair Credit Billing Act of 1974 legislated the chargeback process to help protect consumers; but…

-

What Every Merchant Needs to Know About Friendly Fraud

As card-not-present transactions rise, Visa is addressing the impacts of first party misuse Fueled by the pandemic, the digital economy has grown significantly in the past two years. At Visa, we are continuously listening to and learning from all members of the payments ecosystem. What we’re hearing is that while online purchases are more seamless…